Managers of exchange-traded funds (“ETFs”) are stock pickers…

That might sound like heresy to many folks. After all, ETFs supposedly track indexes.

Sure, that’s what the lawyers make them say. But a lot of rules and choices determine what’s in an index – and in turn, an ETF.

Even the SPDR S&P 500 Trust (SPY) involves choices…

The U.S. Index Committee makes choices that have resulted in a large-cap, quality-momentum collection (portfolio). It’s not a small-cap, balanced portfolio. For that, you would need to invest in the iShares Russell 2000 Fund (IWM).

We all make choices as investors. And we want to make the best ones. That includes deciding which ETFs are the best stock-pickers in a specific area in which we want to invest.

In the August 17 PowerFeed, I explained why I favor the Royce Quant Small-Cap Quality Value Fund (SQLV) over the iShares Russell 2000 Value Fund (IWN).

I want to go a step further today…

In short, the Power Gauge can help us evaluate ETF stock-picking. And we don’t have to work our way stock by stock through any ETF portfolios.

In fact, this process is so easy that I’ve added two more ETFs to our study – the Vanguard Small-Cap Value Fund (VBR) and the iShares S&P Small-Cap 600 Value Fund (IJS).

Let’s get started…

First, the Power Gauge ranks all of these ETFs as “bullish” or better today. That’s thumbs up for small-cap value stocks. So next, we need to find tiebreakers…

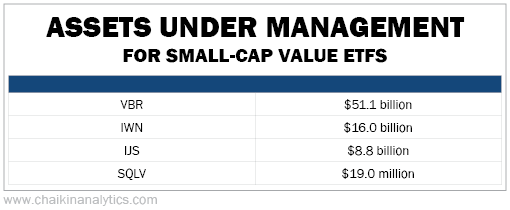

For the first tiebreaker, we’ll compare assets under management (“AUM”). Take a look…

Clearly, VBR is a massive ETF. IWN and IJS are big as well. And SQLV is a pipsqueak.

Asset gathering is the name of the game in the ETF world. IWM, VBR, and IJS can’t gather billions of dollars in assets into their ETFs unless they stick to the basics.

Any nonstandard, strategic choice risks would alienate potential customers and limit AUM.

SQLV’s willingness to occupy an obscure niche suggests it may be open to bold choices.

This insight is similar to a point I made in the August 5 PowerFeed. As I explained, 10-bagger stocks are more likely to be found in “obscure corners of the market.”

Next, let’s turn to another potential tiebreaker…

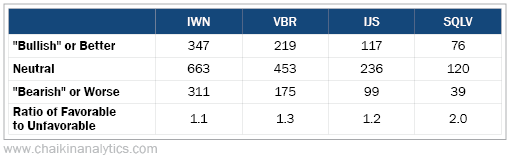

We’ve talked about the “Power Bar” ratio in these pages before. In short, the Power Bar tells us how many stocks in an ETF portfolio have favorable Power Gauge ratings, “neutral” ratings, or unfavorable ratings. Let’s see what it shows about these four ETFs today…

Notice that SQLV wins hands down in this tiebreaker. It’s the best stock-picker.

But for now, let’s continue our analysis to see what these numbers pick up. We’ll peek at what you could find if you looked stock by stock to see which ETF is the best stock-picker.

Let’s start with how each ETF defines value. Each one publishes this information in its prospectus…

VBR and IJS want low tallies for standard ratios like price to earnings and price to sales. That’s generic. But we can’t say it’s “good”…

You can’t divorce what you pay from what you get.

VBR and IJS are like shoppers who are thrilled to pay only $1 for a gallon of milk. Hopefully, though, it won’t be sour.

IWN wants lower valuation ratios and “lower forecasted growth.”

Seriously… lower growth! That’s bad. That’s a ridiculous stereotype.

IWN is like a shopper who insists that the $1-per-gallon bottle contain sour milk. And if the milk is fresh, he will demand a refund.

Like IWN, SQLV also wants lower valuation. But it also seeks strong returns on invested capital, stability of this return, and strong debt coverage.

In other words, SQLV demands low prices and good quality. It wants to buy things worth more than the price it pays. That’s true value investing!

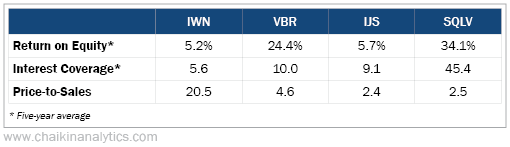

Let’s see how these differences play out in the four ETF portfolios…

In terms of price-to-sales ratio, IJS beats SQLV by a whisker. But when we look at what each ETF gets for its money (company characteristics)… SQLV wins big.

VBR falls short. And IWN – which thinks “value” requires poor growth – is the big loser.

AUM and the Power Bar pick up on what you would want to discover if you manually compared stock-picking proficiency. They’re powerful supplements to the Power Gauge’s ETF rankings.

And as I hope you’ve seen today, they can be the tiebreakers you need as an investor.

Good investing,

Marc Gerstein