Let’s talk about what we really want as investors…

Yes, we all want to find stocks that go up. But let’s try to stand apart from the gazillion other folks who are looking for the same thing…

We really want 10-baggers!

Now, they’re rare. Not many stocks go up 1,000%. So don’t expect to find many.

But there are much worse things in life than a hoped-for 10-bagger that turns into a mere three- or four-bagger. That’s still a significant gain, after all.

So aiming for big returns is a good habit. And the key to finding 10-baggers is…

An open mind.

Now, that’s harder than it sounds. But it’s not impossible. And to get into that mindset, you need to avoid some boneheaded pitfalls.

So today, I’ll help you get into the “10-bagger hunting” mindset. I’ll share my favorite 10-bagger with you. And we’ll learn some of the process I used to hunt for it…

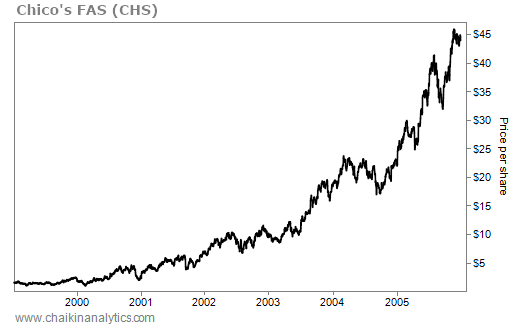

The following chart shows the incredible run of Chico’s FAS (CHS) in the early 2000s…

I bought Chico’s in the spring of 2000. I held my shares as the story played out. And after about five years, I sold – not too far from its peak, considering the stock’s massive gains.

Back then, I wasn’t looking for this company in particular. Frankly, I had never heard of it.

But it kept finding me. It kept popping up on the screens I had developed.

Still, I almost missed it…

That’s because I didn’t have an open mind at first.

The name “Chico’s FAS” sounded hokey. And my screens were producing plenty of other good candidates to examine.

Eventually, I noticed Chico’s on the schedule of a micro-cap conference I was attending.

And as it turned out, that presentation is the kick I needed to buy…

Chico’s was a mall-based retailer of women’s apparel. But it differed from the countless others in some interesting ways…

The company sold stylish, comfortable outfits to women in their 30s, 40s, and older. It was much different from the “skinny youth” look that most of the industry pursued back then.

Chico’s management spoke about collecting and analyzing customer data. It built marketing programs around the data. And it even launched a loyalty program.

This concept is old hat now. But it wasn’t in 2000.

Meanwhile, Chico’s financial-data profile was great…

I won’t pretend to remember the details of my screens from two-plus decades ago. But here’s a clue…

I projected the not-yet-invented Power Gauge model back in time. And if our system would’ve existed in 2000, it would’ve favorably ranked Chico’s.

Folks, you don’t need to hunt for the next company that can clone humans, foster connectivity between people and rodents, or cure COVID-19 with a single-dose pill.

Bold innovation is certainly great. But sometimes, 10-baggers are hiding in plain sight. They can simply be everyday companies getting their edge in the “normal” world.

In order to find a 10-bagger, you need to narrow your focus…

Start by eliminating all the stocks that are too well-known. If you’ve heard the name discussed often, it will be virtually impossible for enough new demand to pull the equilibrium price (the price at which shares demanded equal shares supplied) up 10-fold.

That means the “FAANG” stocks are out. So is everything in the S&P 500 Index. And count out “meme stocks” as well.

The 10-baggers won’t come from the stocks you and everybody else have heard of. They come from the obscure corners of the market – like a retailer with a loyalty program in 2000.

These days, I use the Power Gauge to go 10-bagger hunting. Its systematic approach helps me ignore the old standards and focus on new opportunities.

But no matter what approach you use… don’t forget to keep an open mind.

Good investing,

Marc Gerstein