I’ve got a problem…

Like everyone else, I’m hunting for the stocks most likely to cope with the current bear market. And frankly, I’m getting some good suggestions from the Power Gauge…

Specifically, I’m turning to the “Power Bar” ratio. It breaks down the number of favorably ranked and unfavorably ranked stocks within exchange-traded funds (“ETFs”) at any time.

Two of the top-ranked ETFs among subsectors this week in the Power Gauge are the SPDR S&P Pharmaceuticals Fund (XPH) and the SPDR S&P Biotech Fund (XBI). Based on that, the pharma-biotech universe looks like a good place to hunt for opportunities right now.

But that leads to my problem…

I don’t have the capacity to think intelligently about these types of businesses.

My grandmother wanted me to become a doctor. But I didn’t listen. I’m squeamish. And I barely passed high school chemistry.

Many decades later, reading a biotech earnings release is a mind-numbing experience for me – and likely many of you, too. Just look at this blurb from the latest earnings report by biotech firm Exelixis (EXEL)…

We are pleased with the growth of the cabozantinib franchise, driven by increased demand for CABOMETYX® (cabozantinib) in combination with OPDIVO® (nivolumab) in the first-line renal cell carcinoma setting, as well as by the initial impact of the drug’s most recent U.S. label expansion into differentiated thyroid cancer. As we strive to help as many eligible cancer patients as possible benefit from cabozantinib, we look forward to top-line results from the COSMIC-313, CONTACT-01 and CONTACT-03 pivotal phase 3 clinical trials expected over the course of this year.

Ugh. I could just skip Exelixis and look for another investment. And I’m guessing you’re tempted to do the same thing when confronted with these types of analytical obstacles.

Fortunately, I have a perfect solution to my problem. And even better, it’s something you can follow as well…

In short, we can outsource our research to the Power Gauge and Mr. Market.

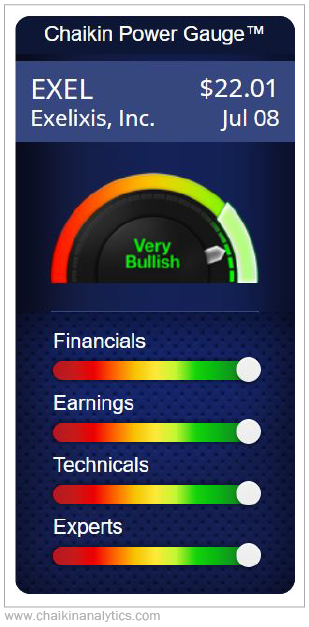

Based on the Power Gauge’s performance record, I can get a good idea about Exelixis’ potential upside simply by noting that it’s now ranked “very bullish” in the system.

But considering my weak understanding of the pharma-biotech space, I need more help. The Power Gauge provides that, too…

Remember, it uses 20 different factors grouped into four categories – Financials, Earnings, Technicals, and Experts. And many different combinations can produce favorable rankings.

Before putting money to work with a stock, I want to make sure it at least ranks OK under the Technicals and Experts categories. These two categories tap most directly into the folks who know more than I do about the important details of a business like Exelixis.

I tested this approach by screening for pharma-biotech stocks in the Power Gauge…

My screen only included stocks ranked “very bullish” or “bullish” overall. And I also required rankings of at least “neutral” in the Technicals and Experts categories.

Now, let me pull back the curtain behind the Power Gauge…

In short, after coming up with my initial screen, I studied the past decade of data relating specifically to the pharma-biotech stocks we’re talking about today.

Assuming 13-week holding periods, the stocks that passed my test had average annualized returns of around 17%. In comparison, a control group of all pharma-biotech stocks was ordinary. It returned about 11.8%, which was roughly in line with the Russell 3000 Index.

So now, thanks to the Power Gauge, I have a lot of credible knowledge about Exelixis. Its overall and specific category rankings exceed my minimum requirements today…

The price chart also looks pretty good right now…

Plus, the Chaikin Money Flow indicator is strong. That tells us the so-called “smart money” is buying. Relative strength has been firmly in the green for several months. And in the past, this stock has performed well at times when the Power Gauge ranked it favorably.

I don’t understand the text of Exelixis’ jargon-filled earnings releases. A lot of folks don’t. But despite those limitations, I know a heck of a lot about this stock…

Specifically, I know the Power Gauge loves what it sees right now. As a result, it’s far more likely to perform well during the current bear market than many higher-profile stocks.

Now, you know that as well…

You’ve seen firsthand how to outsource research on convoluted businesses like pharma-biotech companies to the Power Gauge. I suggest doing that during these rocky times.

Good investing,

Marc Gerstein