In 1969, Dr. Richard Jarecki made a $100,000 bet on a single spin of a roulette wheel…

That is equivalent to roughly $766,000 today. It’s a lot of money for a single spin!

But the 38-year-old medical professor knew the odds were in his favor. In fact, he had beaten the roulette wheel with an ingenious “hack” countless times before…

From 1964 to 1969, Jarecki won around $1.25 million using this hack. (That would be about $9.6 million in 2022 dollars.)

His story is the stuff of legend. And if you haven’t heard it before, I recommend looking it up.

It’s one of the better tales of genius in the pursuit of “beating the house.” But folks, the beat-the-house mentality isn’t just for the casino…

You need to stack the odds in your favor in life, too. That’s especially true in the world of investing.

Today, I’ll show you how I use the Power Gauge to do that. After all, it was developed by a Wall Street legend who dedicated his career to tilting the odds in his clients’ favor.

Once you see how well it works, you’ll want this house-beating hack for yourself…

Regular Chaikin PowerFeed readers know that Marc Chaikin, inventor of the Power Gauge, started on Wall Street in the mid-1960s. And soon after those early days, he dedicated himself to finding market hacks that would help tilt the odds in his clients’ favor.

The culmination of his life’s work is our Power Gauge system. As you know by now, it combines the 20 most important factors used by institutional traders.

The Power Gauge uses a proprietary weighting method to translate the factors into a single, actionable rating for more than 4,000 stocks. It ranges from “very bearish” all the way to “very bullish.”

More importantly, the Power Gauge rating is critical in finding stocks that are set to succeed.

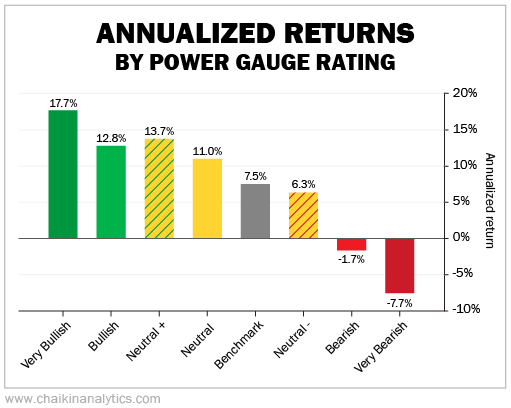

Here’s how it did last year…

There’s a lot going on here. Let me call your attention to a few key points…

First, I’ve included a benchmark to keep us honest.

It’s an equal-weighted version of the Russell 3000 Index. And it follows the same rules the rest of the buckets do. As you can see, this benchmark produced an annualized return of about 7.5% last year (based on rolling returns with a one-quarter holding period).

Next, notice that the “very bullish,” “bullish,” and “neutral+” stocks all beat the benchmark in a resounding way. In other words, investors who use the Power Gauge to select stocks from those three categories are set to shine. They’re choosing the best stocks in the benchmark.

So the Power Gauge is our hack… It stacks the odds in our favor.

But the Power Gauge does more than just direct us to the stocks most likely to outperform. It also helps us steer clear of the worst of the bunch – “bearish” and “very bearish” stocks.

Look at how poorly the stocks in these two categories performed. They actually lost money. So as you can see, the Power Gauge knows how to sift the good stuff from the bad stuff.

The bottom line is… you need to stack the odds in your favor if you want to outperform. And the Power Gauge is designed from the ground up to do just that.

It’s a hack that every investor needs in their toolbox.

Good investing,

Karina Kovalcik

Editor’s note: Our Power Gauge system levels the playing field for everyday investors. It provides a “cheat sheet” on thousands of stocks and exchange-traded funds. With just a few clicks of the mouse, you can see whether a stock is “very bullish”… “very bearish”… or somewhere in between. Get a full walk-through from founder Marc Chaikin right here.