The latest model of an iconic Japanese sports car turned heads…

And not in a good way.

In 2022, Nissan launched the newest version of its Z-series car – the 400Z. It’s the seventh generation of the vehicle.

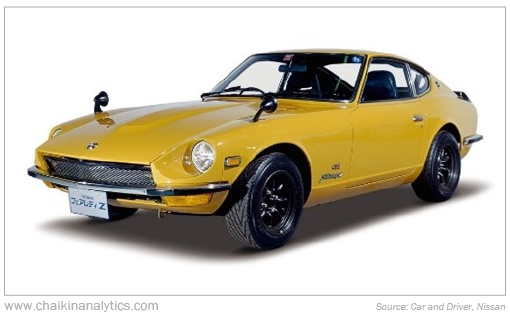

The first generation was originally known as the Fairlady Z in Japan. More than half a million of these cars sold after the 1969 launch. That was a record for a single model of a sports car.

Old models of this car in good condition today still sell for tens of thousands of dollars.

The latest model’s styling offers a classic touch. It has manual transmission as a standard feature. And in the U.S., it even comes in bright yellow – just like the original model.

Here’s what the first-generation sports car looks like…

And here’s the newest model…

You can see that both models have the same basic shape. I can’t deny that the new 400Z is a cool-looking car. And I’m sure a lot of loyal Z-series supporters were excited for its debut.

But a lot of potential buyers ran into a big problem…

The price.

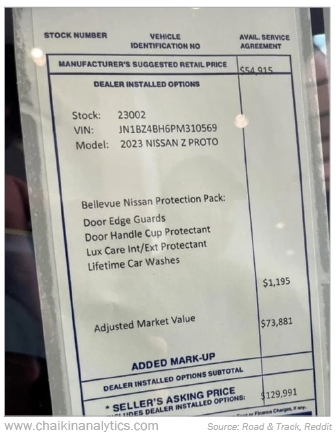

The 400Z debuted at a manufacturer’s suggested retail price (“MSRP”) of about $55,000. That made it one of the most expensive cars in its class.

It gets worse…

Many Nissan dealers charged $76,000 to $80,000 for a 400Z. And in one case, one dealer in Washington state charged an astronomical $129,991 for a limited-edition model…

Notice the “Adjusted Market Value” line near the bottom of the car’s sticker. Yes, that’s a dealer markup of $73,881. The markup on the car was more expensive than its MSRP.

It wasn’t just Nissan’s newest sports car, either…

Big markups on cars and trucks stretched across the entire industry in 2022. Jeep Wranglers, Ford Broncos, Porsche Macans, and more were all priced around 20% above MSRP.

In fact, the average dealer markup to MSRP for new cars that year was 11.5%. That’s more than double the 4.9% average dealer markup in 2019.

Dealers were making out like bandits. The whole situation was nuts. But it all happened for a simple reason…

Supply and demand.

You see, the world had finally exited the darkest days of the COVID-19 pandemic by 2022. However, the global manufacturing supply chain was still in disarray…

For one thing, China is the world’s manufacturing powerhouse. But because of its zero-tolerance policy toward COVID-19, the country remained isolated throughout 2022.

That crippled the world’s supply of many basic car parts.

The pandemic also disrupted the global supply of semiconductor chips. A typical car needs between 1,000 and 3,500 semiconductor chips these days. So the chip shortage led to fewer vehicles rolling off the factories’ floors.

At the same time, U.S. consumers had a ton of cash to spend after the pandemic…

Federal Reserve data showed that Americans had $2.2 trillion in total household savings in 2021. That was an incredible 67% higher than total savings before the pandemic.

A lot of people wanted to buy new cars. But carmakers couldn’t make enough of them.

That meant higher dealer markups.

In the end, though, not enough folks wanted to pay the higher prices…

Car sales hit their lowest level in a decade in 2022. Just 13.7 million passenger cars and light trucks were sold that year. That was down nearly 8% from the previous year.

However, we’re now seeing the industry start to correct itself…

Sales of passenger cars and light trucks in the U.S. jumped more than 12% to more than 15 million units in 2023. And so far this year, sales have continued to grow despite higher interest rates.

Plus, this pickup in spending is happening even as the auto industry deals with slowing electric-vehicle (“EV”) sales.

Sure, not everyone is buying a flashy Nissan 400Z…

But the U.S. is a car-centric country. That means millions of folks want – and in many cases, need – a vehicle.

Put simply, the current U.S. auto industry is looking to get back to – and beyond – its pre-pandemic levels.

And in the latest issue of my Power Gauge Report newsletter – which published last Thursday – I explained how to take advantage…

It’s not via an automaker. But this company helps put vehicle ownership in the hands of folks across the U.S.

Right now, its stock earns a “very bullish” rating in the Power Gauge. And as I explained in the Power Gauge Report issue, more than 40% upside is possible as the U.S. auto market makes a comeback and the car-sales market stabilizes again.

If you aren’t already a subscriber, find out how to get all the details on this brand-new recommendation – and a year of Power Gauge Report for 75% off the regular price – by clicking here.

Good investing,

Marc Chaikin