Folks, we’ve endured a rough week on the global stage…

Islamist militant group Hamas launched a surprise attack on Israel last weekend. According to reports, the death toll in Israel has surpassed 1,200.

Israel quickly responded with a formal declaration of war against Hamas. Prime Minister Benjamin Netanyahu warned that his country would take “mighty vengeance” and prepared for “a long and difficult war.”

Israeli forces then began a major military action in the Hamas-controlled Gaza Strip.

The situation is obviously developing by the day – and sometimes, by the hour. Here at Chaikin Analytics, it’s our duty to break down what everything means for us as investors.

That’s what I’m doing today…

In short, the attack from Hamas happened as the market heads into mid-October. It’s a time when panic often hits the market in one way or another.

Many folks will likely get spooked in the days ahead. Fears of an extended conflict could drive oil prices sharply higher and stocks lower.

As we’ll discuss today, support levels in the S&P 500 Index will likely be tested (and perhaps broken).

That’s especially true if the conflict expands further into the Middle East. If it involves other groups like Hezbollah and its Iranian sponsors, volatility could surge in the market.

But importantly, this development isn’t a reason to panic…

Despite the elevated uncertainty, the “rolling bull market” is alive and well for now. And in the end, this unexpected geopolitical event is a potential buying opportunity…

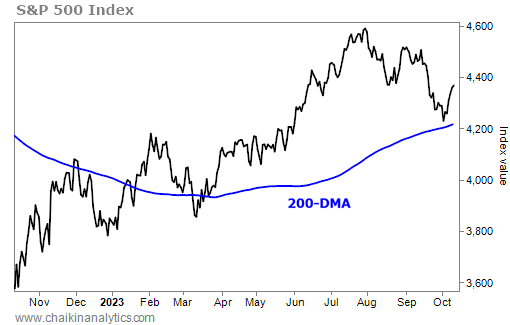

The S&P 500 peaked in late July at nearly 4,600. Since then, the index has declined in an orderly fashion. It’s now down around 5% from its peak.

But importantly, despite this pullback, the S&P 500 has stayed above its rising 200-day moving average (“DMA”). That’s a key indicator of the long-term trend. Take a look…

The 200-DMA is a key level of support for the S&P 500 today. And it’s still on the upswing.

Meanwhile, a sharp spike in oil prices and fears of ever-increasing budget deficits have given “bond bears” a lot of ammunition. As my colleague Marc Gerstein noted on Tuesday, these developments triggered another wave of selling in U.S. Treasurys over the past month.

Weakness in U.S. Treasurys is leading to more fear and uncertainty in many investors’ minds. The 10-year Treasury yield recently spiked to 4.8% (its highest level since 2007).

Before war broke out in the Middle East, oil prices had dropped almost 15% in a week.

But they jumped after the attack over the weekend. And they’ll likely spike higher on a temporary basis because of the escalating tensions in the region.

That usually happens after war breaks out in the Middle East because a large chunk of the world’s oil comes from that area. Stocks often trade lower when conflict happens, too.

But at the same time, we’re now in the sweet spot of the year when stocks often make a “V-shaped” bottom. Historically, they rally in November and December to end the year.

So here’s the deal…

I still believe the “rolling bull market” is alive and well. And once investors assess the situation in the Middle East, we’ll likely get a buyable bottom in stocks.

The S&P 500 closed yesterday at roughly 4,375. The index is down from its July peak. But importantly, it remains up about 14% so far this year.

In short, I’m cautious on stocks today. I’m watching support levels. But no matter what happens, I strongly suggest that you resist the urge to panic over the next couple weeks.

Given all the uncertainty, I understand if you’re uncomfortable with your current exposure to stocks. If that’s the case, then sell down to your “sleep well at night” level.

But whatever you do, don’t panic.

Good investing,

Marc Chaikin