There’s no easy way to say it, folks…

We’re going through a bumpy patch right now.

Specifically, it’s all building up to the middle of this month – around May 15.

You see, the markets are in what I like to call a “seesaw cycle.” By that, I mean the bulk of investors see data and react… see different data and react the other way… then do it again.

And picking the right stocks is more important than anything else in this type of market…

You need to know what’s happening across the investing world to do that consistently. And to that point, the trend on one key fund just broke down on my favorite indicator…

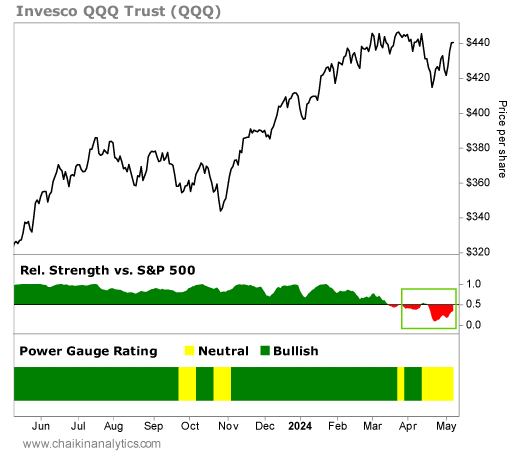

I’m talking about the relative strength of the Invesco QQQ Trust (QQQ).

The Invesco QQQ Trust tracks the Nasdaq 100 Index. Its top holdings include Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), and all the other tech giants.

So it’s a key barometer for the tech space. And right now, it’s underperforming the S&P 500 Index. You can see what I mean in the bottom panels of the following chart. Take a look…

That tells me to tread lightly in the tech space. And I recommend you do so as well for now.

With that said, I wouldn’t bet against tech stocks today. The Invesco QQQ Trust is still above major support levels of $400 to $405 per share. So it took a beating recently, but it hasn’t broken yet.

Again, we’re in a seesaw cycle.

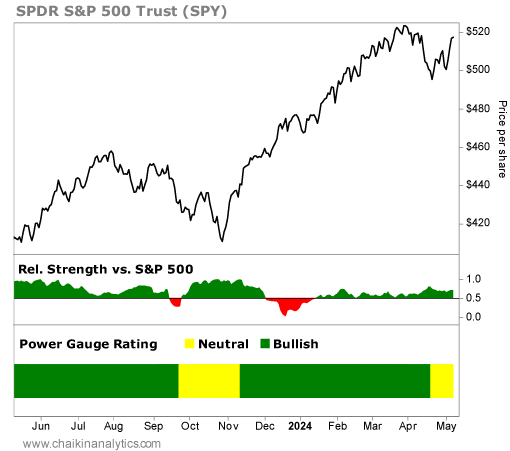

Meanwhile, in the Power Gauge, we use the iShares Russell 3000 Fund (IWV) to track the S&P 500’s relative strength. IWV is a gauge for all types of stocks – from small to large caps. And the SPDR S&P 500 Trust (SPY) serves as our measure for the S&P 500.

You can see that the SPDR S&P 500 Trust’s relative strength is not breaking down today…

The S&P 500 has pulled back since the start of April, of course. But for the most part, the move has been orderly and not chaotic. That type of market action is healthy.

However…

From the middle of this month through August, I expect higher-than-normal volatility.

As the election cycle heats up, related events will bring a truckload of news. And the more uncertain things are, the more volatile the markets will become.

At best, I want to see an orderly pullback of no more than 10%. That would give us a buying opportunity on many strong stocks in strong industries heading into the election.

I’m not saying you should follow the popular Wall Street mantra to “sell in May and go away” – not by any means. Rather, it could be a chance to pick up some great stocks.

I played and coached multiple sports over the past 40 years. And I played football in high school and college.

But ever since high school, a phrase was imbedded into my brain. And as a coach, I passed it on when needed. It works for almost any sport you can play…

Keep your feet moving.

Getting caught flat-footed in any sport is a cardinal sin in a coach’s mind. But in football, moving your feet is a game changer. And believe it or not, it’s safer than just standing there.

Think of me as your coach in the stock market…

In stocks, “keep your feet moving” translates to “move your positions when trends change.” Don’t get caught standing still. You’ll get run over – or worse, you’ll miss a chance to score.

Good investing,

Pete Carmasino

P.S. In my Chaikin PowerTactics newsletter, my goal is to act like your coach in the stock market. That means taking advantage of whatever setups the market throws our way – and changing positions accordingly.

And right now, you can get one full year of PowerTactics at an incredible 50% off the normal price. This offer also comes with free access to our one-of-a-kind Power Gauge system.

But don’t delay – this special offer goes offline tonight at midnight. Learn how to get started by clicking here.