Stuff happens…

For example, your flight could get canceled due to summer storms. That’s bad. It could ruin your entire vacation. And you’ll never get those days back.

But it’s not the end of the world. You’ll eventually get past that type of setback. After all, life goes on. And you still have your health, family, dreams, and everything else.

The same type of thing can occur for us as investors…

Let’s say you own shares of an infrastructure company. You know it’s a pretty good company because the Power Gauge gives it a “bullish” rating.

The company expects its clients to use their money from the Inflation Reduction Act of 2022. Specifically, it believes this law will lead to an influx of new infrastructure projects.

But the clients’ executives find it hard to sift through all the rules of the new law. So they push back their start dates. They want to make sure they do things right.

Stuff happens.

Eventually, the company’s clients will figure it out…

U.S. infrastructure desperately needs to be upgraded. These projects will help. And in turn, the revenue and profits will come through for the company – even if it takes some time.

But when infrastructure leader MasTec (MTZ) cut its guidance on August 4, many investors acted as if the projects were gone forever. And the company’s stock plunged nearly 20%.

This situation isn’t unique, either…

In a span of five trading days earlier this month, 336 companies’ stocks fell at least 10% after they reported earnings. And 85 companies’ stocks plunged at least 20%.

Stuff happens all the time in the market. But as investors, we need to know how to react when others fail to realize that. If we can, we’ll be better off in the long run…

First, it’s important to stick to any stop losses you’ve set.

You’ve done that for a reason. You want to take your emotions out of your investment decisions. So if the stock falls through that level, it’s time to move on.

If you’re a Power Gauge user, you could consider using our system for a similar approach. For example, you could decide to sell when a stock’s Power Gauge ranking falls to “bearish” or “very bearish.”

Our research shows that stocks with these types of Power Gauge ratings perform poorly. So by following that guideline in your own portfolio, you could avoid emotional decisions.

But in most situations, you don’t want to jump ship just because “stuff happens.”

Stuff has always happened. And it always will. So as long as your original reason for buying remains valid, stick it out through the short-term turmoil.

The Power Gauge can help you know whether it makes sense to do that.

Let’s look at MasTec, for example…

The “stuff happens” moment didn’t drive its Power Gauge ranking into “bearish” territory. But the stock dropped below its long-term trend – so it fell from “bullish” to “neutral+.”

It’s an unusual event. And importantly, we can dig deeper into this situation by looking at a bunch of individual Power Gauge factors.

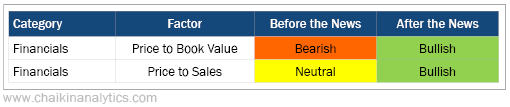

The following table highlights a few factors from the Financials category. As you can see, the stock’s valuation profile actually improved after the bad news came out on August 4…

That’s not surprising. After all, the stock is now more attractive after a nearly 20% fall.

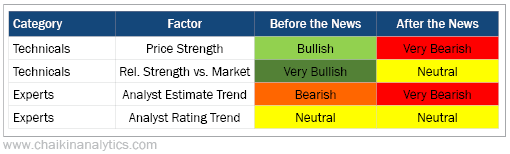

So next, let’s turn to four factors that typically suffer when a company reveals more pessimistic forward-looking guidance. They give us a more detailed picture of MasTec…

The first two factors come from the Technicals category. They reflect the stock’s big drop.

Price strength looks directly at the one-day plunge on August 4. It was more than enough to send this factor down to “very bearish.”

But that alone wasn’t enough to drive MasTec’s overall rating down too far.

Remember, as we’ve discussed before, a lot of factors influence a stock’s price – not just one or two (even if they’re bad). That’s a big reason why the Power Gauge accounts for 20 different factors.

You’ll also notice that the stock’s relative strength versus the market didn’t fall below “neutral.” That’s important in this case…

This factor compares MasTec to all other stocks. Notably, many other companies have their own earnings and guidance concerns. And they’re faring much worse than MasTec.

That brings us to the Experts category…

Analyst estimate trend is now ranked at the lowest possible level – “very bearish.” But it was weak before MasTec released its bad news.

In other words, even before the company cut its guidance, Wall Street analysts weren’t looking for short-term greatness. They’ve always focused on the long-term potential of the infrastructure boom.

The analyst rating trend factor supports that idea. It stood pat at “neutral” after the news.

In the end, I hope this example helps you see that the world doesn’t always run smoothly…

Stuff happens.

But as investors, we need to roll with the punches. When we dig deeper into the data, we can learn a lot. And with a full suite of 20 factors, the Power Gauge helps us do that.

Good investing,

Marc Gerstein