It’s time to dig, break rocks, and pour cement…

In other words, it’s infrastructure time.

The U.S. Senate voted in favor of the Inflation Reduction Act of 2022 on August 7. Then, the House of Representatives approved it Friday. And President Joe Biden will soon sign it into law.

Don’t let the name throw you off. This mega-sized bill covers all types of spending.

For example, it earmarks $3 billion specifically for the redesign of community roadways. And it also has billions of dollars set aside for similar projects to explore “low carbon materials.”

In many ways, it’s an extension of Biden’s failed “Build Back Better” framework. And no matter how you feel about that, one thing is clear…

Uncle Sam is about to spend a ton of money in an investable industry.

Today, I want to focus on the law’s expected boost for American infrastructure. And as I’ll show you, the Power Gauge is pointing to an incredible opportunity in this space…

Regular readers know the “Power Bar” ratio in the Power Gauge breaks down the number of favorably and unfavorably ranked stocks at any given time. And right now, the Power Bar shows us that construction and engineering is emerging as a hot industry…

Construction and engineering is now second out of 68 industry groups in terms of the Power Bar. In the group, 25 stocks are ranked “bullish” or better. And none rank “bearish.”

The Power Gauge also ranks the Global X U.S. Infrastructure Development Fund (PAVE) as “very bullish” today. And its Power Bar currently shows 53 favorably ranked stocks and only six unfavorably ranked.

That’s much different from when the Build Back Better Act failed last fall.

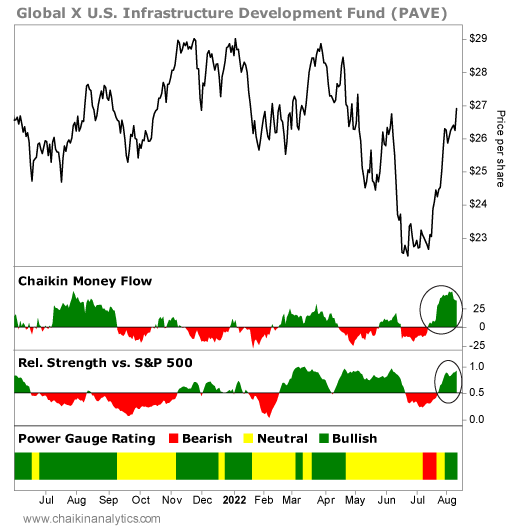

Back then, the Power Gauge showed us that two important factors were absent. You can see what I mean in the following chart…

Notice that PAVE’s relative strength versus the broad market was lackluster when the Power Gauge turned “bullish” last fall. And the Chaikin Money Flow – our proprietary indicator that tracks the behavior of the so-called “smart money” (institutional investors) – was poor, too.

It also looked like PAVE might present a buying opportunity in the spring, when the Power Gauge flipped to “bullish.” But notice that the overall Power Gauge rating and Chaikin Money Flow readings quickly turned against this group.

However, everything is now roaring back to life…

The Chaikin Money Flow indicator shows us that the smart money started pouring money into PAVE again in recent weeks. The relative strength indicator is clearly positive now, too. And the Power Gauge is now firmly in “bullish” territory as well.

Folks, it looks like the next infrastructure boom is upon us. And you’ll likely start considering how to put your money to work in this segment in the near future.

With the Power Gauge’s help, it’s clear that PAVE is a great way to do that today.

Good investing,

Marc Gerstein