Everyone is keeping a close eye on the war between Israel and the militant group Hamas…

Even major financial publications like Bloomberg and the Wall Street Journal are watching. They’re publishing the latest updates as “front page” news.

Now, the human cost of the war is obvious. And it’s a sad, horrific situation.

But as Marc Chaikin noted last Thursday, it’s our duty at Chaikin Analytics to look at everything from an investing angle. And if you’re a market junkie, you’ve likely already thought about which stocks could benefit or suffer from an extended conflict.

Two obvious topics come to mind…

- Energy

- Defense

Marc touched on energy prices in his essay last week. So today, let’s look at defense stocks…

After all, the U.S. sent the USS Gerald R. Ford aircraft carrier to the eastern Mediterranean Sea last week. The Navy calls it the “biggest, baddest warship.”

The U.S. also ordered the USS Dwight D. Eisenhower aircraft carrier to the region over the weekend. So it’s ramping up its presence in international waters off Israel’s coast.

And we know that the U.S. is supplying Israel with precision air-to-ground munitions. F-16 and F-35 fighter jets and Apache helicopters use these types of weapons.

So with that in mind, I understand if you’ve turned your attention to defense stocks in recent days.

As I’ll show you today, the Power Gauge’s take is shifting as well. But it’s not time to go all-in just yet. For now, our one-of-a-kind system encourages a “wait and see” approach…

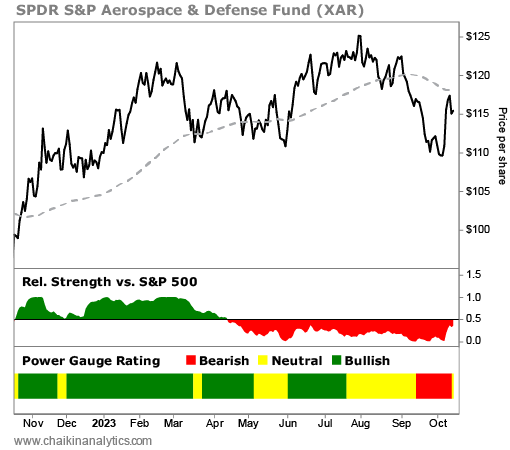

In the Power Gauge, we use the SPDR S&P Aerospace & Defense Fund (XAR) to track the aerospace and defense subsector…

XAR is a “one click” way to invest in roughly 30 stocks in this subsector. Its biggest holdings include defense-industry heavyweights Lockheed Martin (LMT), General Dynamics (GD), and Northrop Grumman (NOC). And it also holds smaller companies like Kratos Defense & Security Solutions (KTOS).

Here’s how the Power Gauge sees XAR today…

You’ll notice that XAR has jumped around 6% off its recent bottom. And notably, the Power Gauge’s grade for XAR flipped from “bearish” to “neutral” at the end of last week.

Still, it’s not time to pull the trigger yet…

Our proprietary relative strength indicator shows that XAR has underperformed the S&P 500 Index since April. And today, XAR remains below its long-term trend (the gray dashed line).

Things are looking up for XAR. But the trend still isn’t completely on our side.

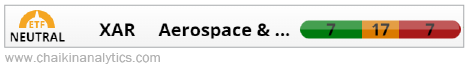

A look at XAR’s Power Bar ratio points to a mixed bag as well. Of the 31 holdings with Power Gauge ratings, seven hold “bullish” or better ratings. And seven are “bearish” or worse…

Northrop Grumman and General Dynamics are two of the companies with “bullish” grades. Meanwhile, Lockheed Martin and Kratos both hold “neutral” ratings today.

Some aerospace and defense companies are moving up. And the Power Gauge recognizes the potential in this part of the market.

But that doesn’t mean you should rush into the entire space yet. The Power Gauge also helps us see that the situation is complicated…

The U.S. is burning through its stockpile to help Ukraine fight Russia. Now, it’s also assisting with Israel’s fight against Hamas. As Secretary of Defense Lloyd Austin said last week…

We’re going to do what’s necessary to help our allies and partners, and we’re going to also do what’s necessary to make sure that we maintain the capability to protect our interests and defend our country.

That sounds like a good thing for the aerospace and defense subsector. But as we’ve seen today, it hasn’t yet translated to a broad buying opportunity across all of these stocks.

So for now, I’ll be watching closely in the Power Gauge. And I recommend you do the same.

Good investing,

Vic Lederman