Editor’s note: Here at Chaikin PowerFeed, we’ve discussed artificial intelligence (“AI”) many times…

Amid the recent market volatility, tech stocks stumbled. But AI is still a long-term megatrend. And as it continues to develop, investors will keep looking for ways to profit.

That brings us to today’s essay by our friend Sean Michael Cummings. He’s an analyst over at our corporate affiliate Stansberry Research. And this essay first published in Stansberry’s free DailyWealth e-letter yesterday.

In it, Sean discusses a company that has recently been turning heads in the AI space – and why its stock could be poised for more gains ahead. In fact, our Power Gauge system agrees. It’s “bullish” on this stock today.

Here’s Sean with what he’s seeing right now…

A new ChatGPT killer has just hit the scene…

If you’ve been following the developments in AI software, you’re well aware of ChatGPT – the online chatbot created by OpenAI.

While OpenAI runs the most popular AI chatbot on the market, it’s not the only option out there. And its competitors excel at different tasks…

For example, the Claude 3 Opus chatbot – created by OpenAI’s rival Anthropic – outperforms ChatGPT in graduate-level reasoning and other tasks. And Google’s Gemini uses real-time Internet searches, which keeps it more updated than ChatGPT.

Today, a new challenger is making noise in the AI-chatbot market.

This company’s model has ChatGPT beat at various high-level tasks. And as I’ll explain, its stock is in a new, noteworthy uptrend…

The company I’m talking about is the “Amazon of China” – Alibaba (BABA).

This $205 billion giant does it all. It has segments in e-commerce, retail, technology, Internet, movies, and more.

In April 2023, Alibaba released its AI chatbot called Tongyi Qianwen. And it seems the bot’s newest model, Qwen2.5, has leapfrogged ChatGPT.

According to AI-benchmark group OpenCompass, the Qwen model outperforms OpenAI’s chatbot in both language and reasoning.

Qwen poses major competition to ChatGPT. It has already seen 90,000 adoptions by companies across various industries.

But unlike OpenAI, Alibaba is a publicly traded company. That means investors can buy BABA shares to benefit from the AI tailwinds that are forming behind it.

And right now, the timing looks especially promising. See, for the first time since September 2023, BABA shares are back in an uptrend.

We can see this shift using BABA’s 200-day moving average (200-DMA)…

This indicator shows a rolling average of the past 200 days of prices. It removes the noise of daily price moves and lets us see the overall price trend instead.

When an asset’s daily price breaks out above its 200-DMA, it shows us that daily prices are jumping relative to the long-term trend. It’s a bullish signal that tends to lead to more gains.

And it’s exactly what we’ve just seen with BABA. Take a look…

As you can see, BABA hasn’t pierced its 200-DMA for the better part of a year.

I wanted to find out what this kind of breakout meant for future returns. So I examined every other time BABA broke out above its 200-DMA to see how the stock performed from there.

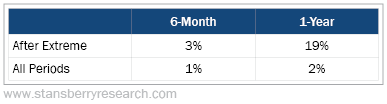

It’s rare for BABA to overtake its 200-DMA. Since 2014, this price action has only occurred on 1.5% of days. But history shows buying after this signal leads to terrific performance. Check it out…

BABA has underperformed in the long term, returning just 2% in an average year. But buying after the stock breaks above its 200-DMA can significantly boost returns…

This signal led to 3% returns in an average six-month period… and that gain jumped to 19% after a year.

That’s why it’s so important to wait for the uptrend.

It’s a way to avoid false starts and make sure prices are moving in the right direction… And if you buy stocks with momentum, that’s when they can really take off.

Today, BABA is on a hot streak. So if you’re interested in this technology, don’t overlook this unsung AI challenger… History shows it’s likely worth considering right now.

Good investing,

Sean Michael Cummings

Editor’s note: Sean and the rest of the DailyWealth team aim to share the world’s best wealth ideas with their readers – including potential opportunities in specific stocks.

And just like the PowerFeed, this e-letter publishes in the morning every weekday the markets are open. It’s also 100% free. Learn more about DailyWealth and sign up for it right here.