Folks, a serious divergence is happening in the market right now. And it’s one that most investors aren’t paying attention to.

After all, tech stocks have dominated the investing narrative over the past few years. We’re seeing that play out this year, too.

Despite recent turmoil, the Technology Select Sector SPDR Fund (XLK) has soared an incredible 40% over the past year. That outpaces the S&P 500 Index’s 28% return over the same time frame.

And that makes it the top-performing sector in the Power Gauge over the past year…

You see, our one-of-a-kind system ranks 11 top-level market sectors. It also ranks 20 subsectors.

And right now, something unusual is going on in the market. That’s because a high-performing subsector is closely related to a poor-performing top-level sector.

Let’s take a closer look…

If you haven’t guessed already, today we’re looking at the real estate sector and the homebuilders subsector.

That’s right – the homebuilders subsector is the best-performing subsector over the past 12 months. The SPDR S&P Homebuilders Fund (XHB) rose more than 50% over that time frame.

That’s an incredible result for such a niche subsector.

But here’s the thing…

The top-level real estate sector is telling an incredibly different story. The Real Estate Select Sector SPDR Fund (XLRE) isn’t even up 10% over the past 12 months.

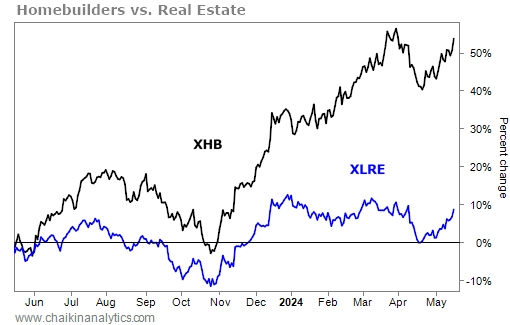

That makes the real estate sector one of the worst-performing sectors in the Power Gauge over the past year. Take a look at XHB and XLRE together on a chart:

As you can see, it’s a big gap. And it’s one that has only widened this year.

In fact, XHB is up roughly 15% so far this year. Over the same time frame, XLRE has lost roughly 3%. And looking ahead, XHB is rated “very bullish” in the Power Gauge. Meanwhile, XLRE has a “very bearish” rating.

That’s about as dramatic as it gets.

Now, regular Chaikin PowerFeed readers will already know some of the “why” behind this. Back in January, Marc Chaikin warned readers to “expect the housing market to stay tight.”

And as he also explained…

The annual rate of new single-family homes sold in the country is around 590,000 (as of November). That might sound like a lot at first. But… it’s well below most of the 1990s and 2000s – and even most of the 1980s.

Put simply, the U.S. is still facing a housing shortage. And that means that homebuilders have a massive tailwind behind them.

But when it comes to “real estate” as a whole… it’s a different story. The reality is that the pandemic is still causing a “hangover” in commercial real estate.

Occupancy is still below “normal” levels. And that means that commercial buildings are producing less income than investors expected them to.

That’s terrible for companies with exposure to commercial real estate. And it’s why we’re seeing the top-level real estate sector continue to stumble.

Folks, the takeaway from all of this is simple…

The homebuilders subsector and the real estate sector may sound like they go hand in hand.

But they’re dramatically different segments of the market. And they help illustrate that there’s nearly always an opportunity – or something to be wary of – hiding somewhere.

I’ll be using the Power Gauge to help me find the opportunities. And I’ll also use it to help me avoid the traps.

Good investing,

Vic Lederman