If you want to start an argument, just say “electric vehicles”…

On one hand, electric vehicles (“EVs”) are more expensive. EVs cost about $12,000 more than the average car on the market, according to Kelley Blue Book estimates.

And for the privilege of paying more, EV drivers get to stress over battery life…

You can completely fill a gasoline-burning vehicle’s tank in minutes. But charging a fully drained EV battery at home can take anywhere from eight to 70 hours.

On the other hand, EV supporters will tell you that the charging problem is getting better. A super “Level 3” charger only requires about 20 minutes to go from 10% to 80% charged.

But if you’re out of town, you often need to hunt for a charger…

As of January, the U.S. had more than 160,000 public charging stations. According to S&P Global, though, we’ll need 700,000 chargers by 2025 to fill the growing demand for EVs.

Speaking of that, folks like United Nations Secretary-General Antonio Guterres believe we need EVs – or else. He says that fossil fuels are “incompatible with human survival.”

My point is…

It’s a hot-button issue. And supporters and critics can both make strong cases.

But as investors, we only care about finding the moneymaking opportunities.

Today, we’ll investigate one of these opportunities together…

President Biden signed an executive order in August 2021 that would boost EV market share in the U.S. to roughly 50% by 2030. Then, this past April, the U.S. Environmental Protection Agency proposed tailpipe-exhaust rules that could boost it to 67% by 2032.

For perspective, EVs make up about 6% of all new-car sales in the U.S. right now.

At the state level, the shift to EVs is in full swing as well. Last summer, California banned sales of gasoline-powered vehicles after 2035. And New York soon followed suit.

Whether you’re for or against these mandates, you can’t deny their impact. A lot of companies are developing and selling chips and other EV parts because of these mandates.

That will drive many companies and stocks forward in the months and years ahead. And fortunately for us as investors, the Power Gauge is already pointing to likely winners…

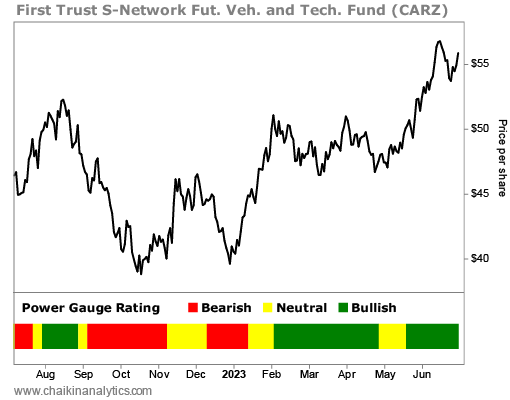

We can see that by looking at the First Trust S-Network Future Vehicles and Technology Fund (CARZ). It earns a “very bullish” rating from the Power Gauge today…

This exchange-traded fund (“ETF”) holds shares of all the usual big names – Tesla (TSLA), Ford Motor (F), and General Motors (GM). Plus, it also invests in non-U.S. EV makers.

The ETF includes companies that help make EVs possible as well. For example, its largest holding is chipmaker Nvidia (NVDA). And it holds shares of many other chipmakers.

Now, CARZ is a tiny ETF. It only has about $40 million in assets under management.

In terms of stocks, tiny can be scary and dangerous. (Think “penny stocks.”) But ETFs are different…

As long as the stocks in the ETF’s portfolio are tradeable, the ETF is fine for investors. (I talked about this idea last August.) That’s the case with CARZ…

In the end, this ETF allows investors to take a concentrated position in the EV industry. And whether you like it or not, Uncle Sam is forcing money into that industry in the years ahead.

Thanks to the Power Gauge, we can see the opportunity. Give CARZ a look today.

Good investing,

Marc Gerstein