When I started working on Wall Street, we hadn’t yet landed on the moon…

Now, the U.S. government is planning to spend a ton of money on space lasers.

No kidding…

The White House released its 2024 defense budget request last month. And in the proposal, it earmarked roughly $30 billion for the sixth branch of the U.S. military.

In case you’re not aware, the sixth branch is the U.S. Space Force…

This space-defense organization formed in 2019. It’s under the Department of the Air Force – like how the U.S. Marine Corps falls under the Department of the Navy.

Among other innovations, it’s pursuing laser technology to connect satellites orbiting Earth.

Now, I can’t pretend to know all the ins and outs of the latest “galactic” arms race…

But I can tell you that people are still people. And they’re motivated by the same factors as always. So no matter where the conflicts occur, it’s reasonable to expect they’ll happen.

With that in mind, it makes sense that the U.S. government wants to have the best protection available. And that’s the case even if it’s literally out of this world.

More importantly, as investors, we can profit from these advanced technologies…

This industry is outperforming the broad market over the past six months. And as I’ll show you today, the Power Gauge expects this outperformance to continue in the months ahead…

The aerospace and defense industry is an area of long-term strength for investors. And over the past year, we’ve seen why…

On March 4, 2022, not long after Russia invaded Ukraine, we talked about the world’s armies in these pages. We noted how they were increasing military budgets just in case.

That’s still true today. And it means the biggest defense contractors will likely keep thriving.

We can track this industry through the SPDR S&P Aerospace & Defense Fund (XAR)…

This exchange-traded fund (“ETF”) holds shares of 33 companies within the industry. Its top 10 holdings include familiar names like Raytheon Technologies (RTX), General Dynamics (GD), Northrop Grumman (NOC), and Lockheed Martin (LMT).

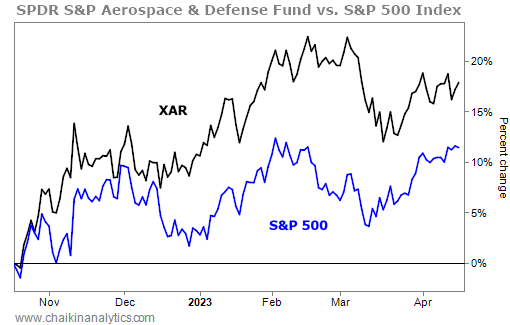

XAR is beating the benchmark S&P 500 Index in a big way over the past six months. Take a look…

XAR is up around 18% over that span. Meanwhile, the S&P 500 is only up about 11%.

The Power Gauge helps us see that this outperformance should continue, too. To show you what I mean, let’s turn to XAR’s Power Bar ratio…

As we’ve explained before, the Power Bar ratio is part of our one-of-a-kind system. It compares the number of favorably and unfavorably ranked holdings in an ETF at any time.

The Power Gauge is currently “bullish” on XAR. And here’s the current Power Bar ratio…

As you can see, 13 of the 33 ranked stocks in XAR currently earn “bullish” or better ratings (marked in green). And only three stocks earn “bearish” or worse ratings (marked in red).

Now, look at the yellow part of the Power Bar. That part represents the stocks with “neutral” ratings. And today, 17 stocks within XAR fit into this part of the Power Bar.

That’s more than half the ETF.

Meanwhile, XAR recently entered a “cooling off” period. It’s underperforming the S&P 500 over the past three months. XAR is up around 4%, while the S&P 500 is up about 6%.

So what does that all mean for us as investors?

In short, XAR is positioned for another run of outperformance…

The Power Bar ratio helps us see that the ETF has far more “bullish” or better stocks than “bearish” or worse ones. And with 17 holdings in the “neutral” zone, it could soon turn even more positive.

Don’t forget that the U.S. government is about to pour billions more into this space…

As that happens, this strong industry trend will likely resume. And it could get even stronger.

Put simply, the aerospace and defense industry is full of opportunity today.

Good investing,

Marc Chaikin

P.S. I learned a long time ago that the market isn’t just one entity that goes up or down…

In reality, it’s much more nuanced than that. Aerospace and defense is one of the smaller parts of the market. And right now, the Power Gauge tells us it’s full of opportunity.

But that’s not the case everywhere…

A new wave of crashes is set to rock the market this year. And if you’re not careful, your portfolio could get wrecked. Find out what you can do to prepare immediately right here.