Sī vīs pācem, parā bellum.

This Latin phrase translates to “if you want peace, prepare for war.”

Politicians have followed versions of this mantra for centuries, all the way back to the Roman Empire. President Ronald Reagan famously used a version of it with the “Peace Through Strength” slogan in the 1980s during the Cold War with the Soviets.

In short, military deterrence is a longstanding precaution against war…

The entire NATO alliance is predicated on “an attack on one is an attack on all.” While the U.S. has led the way in the past, that’s no longer the case…

Now, after Russia’s attack on Ukraine, other NATO countries are increasing their military budgets. With the world on edge and World War III looking like a possibility, it’s time to create peace through military strength once again.

Nobody knows what will happen next…

Will Ukraine fall to Russian forces and that be it? Will Russian President Vladimir Putin test NATO and go into Poland or the Baltic states? Will Russian forces face stiff resistance from the Ukrainian people and find a new stalemate?

In the meantime, whatever happens, the markets will likely be volatile.

That brings us to the point of our discussion today… With countries now increasing their military budgets to deter an outside attack, what should you do as an investor?

Fortunately, when it comes to your portfolio, our Power Gauge has answers. And today, I’ll show you its reading on a classic wartime investment strategy…

What companies will do well during this military buildup and preparation?

The Power Gauge has already sniffed out an area of market strength – aerospace and defense. And when you stop and think about it, that makes sense…

As military budgets rise, companies that make planes, helicopters, bombs, and radar systems will sell more. These are all things the world’s armies need to protect their homelands. And as that happens, the biggest defense contractors will thrive…

I’m talking about companies like Lockheed Martin (LMT). It’s one of the world’s largest defense contractors. The Power Gauge is currently “very bullish” on the company.

General Dynamics (GD) is another “very bullish” defense contractor. It makes nuclear-powered submarines, guided missiles, tanks, and armored vehicles.

These two companies and many other defense-related stocks – such as Northrop Grumman (NOC) and Raytheon Technologies (RTX) – are all found in one convenient place… The SPDR S&P Aerospace and Defense Fund (XAR) holds about 30 companies in this space.

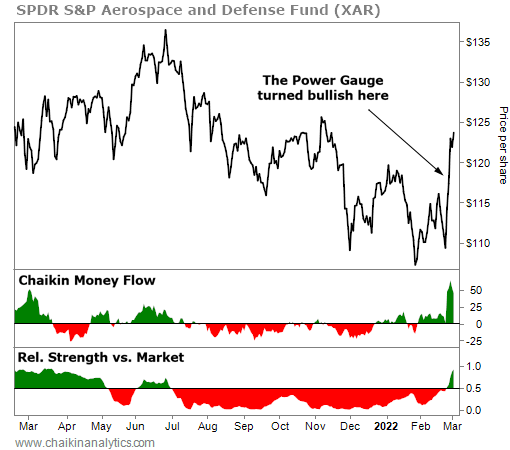

And just recently, the Power Gauge signaled a buying opportunity in XAR. Take a look…

Notice that the Power Gauge moved to “bullish” for XAR on February 25. And the exchange-traded fund’s share price is just starting to head up. You’re still early in this game.

Better still, our proprietary Chaikin Money Flow indicator signaled heavy buying in recent days. That means institutional traders – the so-called “smart money” – are pouring into this space right now.

And not surprisingly, the exchange-traded fund just started outperforming the S&P 500 Index, too. You can see that in the “relative strength vs. the market” panel of the chart. That means now is the time to act.

When you combine everything, it’s a recipe for big returns.

So folks, if you’re looking for somewhere to put your money to work in this volatile market environment, remember the old Latin phrase… Sī vīs pācem, parā bellum.

Good investing,

Carlton Neel