Folks, the Nasdaq 100 Index’s “special rebalance” is a multitrillion-dollar juggling act…

In short, as I explained on Tuesday, stock-exchange operator Nasdaq is making changes to stay in check with its rules on diversification. Specifically, it’s trying to mitigate what the industry calls “concentration risk.”

Big Tech stocks like Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOGL) are involved. Those four stocks combine for a whopping $8.4 trillion in market cap.

But here’s the catch…

One company will get the most money from the selling that happens after the Nasdaq’s special rebalancing. And as I’ll explain today, the Power Gauge spotted it months ago…

I’ll get right to it…

The stock that stands to benefit the most is semiconductor maker Broadcom (AVGO).

Broadcom is already surging ahead of next week’s special rebalance. It’s up around 47% since May 2. Meanwhile, the S&P 500 Index is only up about 11% over that span.

The reason for that massive outperformance is simple…

According to a report from investment bank Goldman Sachs, the stocks that will benefit the most rank in order.

Remember, the Nasdaq 100 is a market-cap-weighted index. That means the biggest stocks get the largest weightings within the index.

Here’s the kicker…

Broadcom is the highest-weighted stock that won’t get reduced in the special rebalancing.

The stock’s weighting in the Nasdaq 100 came in at 2.4% before the announcement earlier this month. When the special rebalancing occurs next week, its weighting will rise to 3%.

Now, an increase of less than a percentage point doesn’t sound like much. But it represents about $1.6 billion. And it equals nearly 65% of Broadcom’s three-month average trading volume.

So in that context, it is a lot.

But the thing is…

The Power Gauge saw Broadcom’s potential way before the Nasdaq announced its special rebalancing.

Regular readers know our process at Chaikin Analytics starts with the Power Gauge. It rates more than 5,000 stocks and exchange-traded funds from “very bullish” to “very bearish.”

The Power Gauge rating is fundamentally weighted. It assesses every company in terms of factors like debt-to-equity ratio, price-to-sales ratio, earnings surprise, and return on equity.

But that isn’t all it does…

Our system combines fundamental and technical information as well. That allows us to dissect an opportunity when both the fundamental and the technical indicators line up.

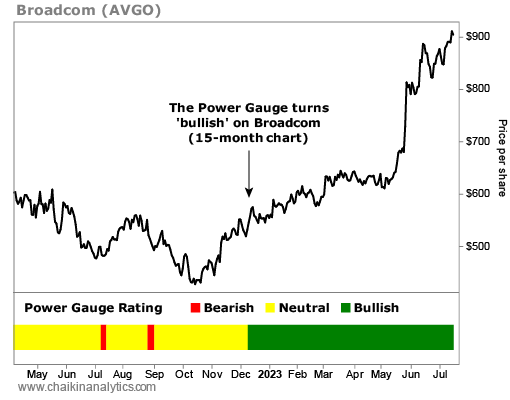

And that’s exactly what happened with Broadcom at the end of last year. Take a look…

As you can see, the Power Gauge consistently rated Broadcom as “neutral” or “bearish” starting in April 2022. But then, our system turned “bullish” on the stock on December 9.

Broadcom closed at roughly $545 per share that day. Earlier this week, the stock hit an all-time high of more than $910 per share.

That’s an incredible return of about 67% in a little more than seven months.

Put simply, with the Power Gauge at your side, you could’ve found this opportunity long ago. You would’ve been ready to act way before the Nasdaq’s rebalancing was even announced.

Now, thanks to the esoteric workings of index formation, the stock still has a major tailwind behind it. So if you weren’t watching Broadcom before, I recommend doing so now.

The Power Gauge agrees as well. It’s still “very bullish” on the company today.

Good investing,

Pete Carmasino