A major change is about to take place in the markets…

It will touch nearly every American’s investment account.

Put simply, the powers that be are changing the way the Nasdaq 100 Index holds stocks.

They’re tweaking the so-called “weightings” within the index. Their goal is to dilute the impact of the biggest stocks.

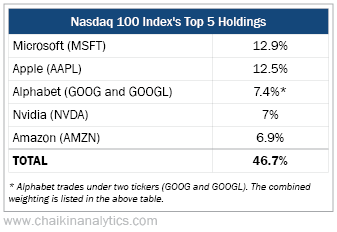

I’m talking about the Big Tech stocks that nearly everyone holds in their investment accounts. These stocks include Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Nvidia (NVDA), and Amazon (AMZN).

They’ve been on a major tear so far this year. And now, these stocks make up an unusually large part of the Nasdaq 100.

But that won’t be the case for long…

Next week, the folks at Nasdaq will make a change that pushes billions of dollars out of those stocks. And just like that, the money will flow into the smaller stocks in the index.

So today, let’s take a closer look at what it all means for us as investors…

The exchange-traded fund (“ETF”) that tracks the Nasdaq 100 is the Invesco QQQ Trust (QQQ).

With more than $200 billion in assets under management, QQQ is the fifth-largest ETF in the world. It’s one of the most traded ETFs, too. An average of roughly 52 million QQQ shares have exchanged hands daily over the past three months.

And importantly, QQQ is about to experience a major shakeup…

You see, the Nasdaq 100 is designed to track 100 of the largest nonfinancial companies on the Nasdaq exchange. But there’s a problem with that right now…

The top five holdings currently make up roughly 47% of the Nasdaq 100.

Take a look…

That’s a lot of exposure to a small group of stocks. It means that these five companies hold almost the same weighting as the other 95 stocks within the Nasdaq 100.

As a result, the folks in charge are making a big change. They announced a “special rebalance” of the Nasdaq 100 that will take effect before the market opens next Monday, July 24.

In short, the index follows a certain set of criteria – or a “methodology.” And a special rebalance can take place any time the total weight of companies with at least 4.5% holdings tops 48%. That happened recently, before the percentage dropped back to its current level.

According to the Nasdaq 100’s methodology, the top five companies should make up a smaller portion. So after the special rebalance, they’ll make up 38.5% of the index.

Folks, the takeaway is simple…

These companies are about to become less of nearly every investment account in America.

The rebalance is causing waves in indexes other than the Nasdaq 100, too. No matter where these top five stocks are, the selling will weigh on their prices. So we can expect volatility.

But importantly, there will be some winners in this situation as well…

The changes in the Nasdaq 100 will force the ETFs that track the index (like QQQ) to recalibrate their weights as well. In other words, the top stocks will move down to levels that look less top heavy. And that money will go toward other stocks within the ETFs.

So don’t be surprised if your Nasdaq-related holdings seem especially volatile in the coming weeks. This is a selling and buying scenario. Volatility can occur when that happens.

Be prepared, but don’t overreact.

A special rebalancing has only happened twice before – in 1998 and 2011. Each time, the market saw volatility at first. But before long, the Nasdaq returned to its outperformance.

So let the market react first. Then, at that point, we’ll reassess the trend.

If history is any guide, this special rebalancing will just be a speed bump for the Big Tech companies. If they’re as good as the buying suggests, they’ll quickly take the lead again.

Good investing,

Pete Carmasino