Folks, consumer sentiment is bad overall right now. And it’s especially bad in China…

In fact, China’s consumer confidence index is at its lowest recorded level. The data goes back to 1991 – a span of 31 years.

But frankly, it doesn’t surprise me. After all, as my colleague Carlton Neel detailed on Friday, the Chinese government chose to lock down some of its largest cities in response to recent COVID-19 outbreaks.

This trend is evident in China’s retail sales data, too…

In April, the country’s retail sales declined roughly 11% year over year. For comparison, retail sales in the U.S. climbed more than 7% over the same span.

Despite the growth in retail sales over the past year, U.S. shoppers are feeling pretty miserable, too. Consumer sentiment in this country is at its lowest level since 2011.

Now, I don’t wish misery on anyone. But today, I want to show you why the current consumer despair is actually a bullish signal.

In fact, it means the bottom is likely nearer than most folks realize. And in turn, we need to start watching the Power Gauge closely for signs to buy in the broader markets…

As I said, U.S. consumer sentiment is at its lowest level since 2011. That’s important…

You see, people don’t stop feeling miserable until after a crisis has passed its bottom. It’s human nature to feel sorry for yourself for some time longer than you should.

And it’s not unusual for consumers to feel the worst just as things are about to turn for the better. To see what I mean, you’ll need to see the following chart…

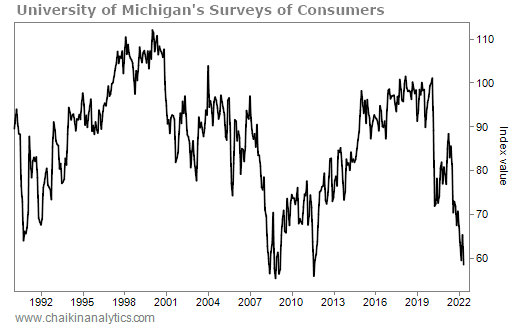

The chart shows the data from the University of Michigan’s Surveys of Consumers starting in 1990. And you’ll notice something funny…

Consumer sentiment typically drops to its lows long after major market events.

The dot-com bust ended in October 2002. But consumer sentiment didn’t turn the corner and head higher until 2003. And during the housing bust, even though the market bottomed in March 2009, consumers remained more miserable than normal through 2011…

So as much as it pains me to say… It’s OK to hear that Chinese consumer sentiment is at a record low today. After all, we’re nearly two and a half years into the COVID-19 pandemic.

If anything, the general misery is a sign that we’re about to turn the corner for the better.

But that doesn’t mean you want to jump back into any broad market bets just yet…

The Power Gauge still rates the SPDR S&P 500 Trust (SPY) – which tracks the benchmark S&P 500 Index – as “neutral” today. And as you can see, our system’s ratings for the individual stocks within the index are still pretty mixed right now…

As of Friday, 102 stocks in the S&P 500 earn a “bullish” or better rating in the Power Gauge. And the same number of stocks are in “bearish” or worse territory.

The Power Gauge views the KraneShares CSI China Internet Fund (KWEB) in a similar way today…

KWEB holds some of China’s largest tech companies, like Tencent, Alibaba, and JD.com. They’re comparable in economic importance to U.S. companies like Alphabet (GOOGL), Meta Platforms (FB), and Amazon (AMZN). And the Power Gauge is “neutral” on KWEB today as well.

Both the broader U.S. market and these Chinese mega tech stocks are doing terribly this year. The S&P 500 is down roughly 14%. And KWEB is down almost 20%.

In other words, they’re still not around the corner and heading higher yet. So that leaves us in a “wait and see” situation right now…

Consumer sentiment is signaling that the bottom is near. And stocks in the U.S. and China have reached significant lows. But importantly, the uptrend we like to see isn’t here yet.

I’ll keep using the Power Gauge to watch for it. I suggest you do the same.

Good investing,

Marc Gerstein

Editor’s note: As Marc explained, the Power Gauge is our guiding light. It helps us quickly scan the markets to find the best places to put our money to work at any given moment.

That’s critical in tough times like right now. Most of the market’s sectors are down this year. And a couple sectors are down more than 20%. If you’re worried about not knowing what to buy, you’ll want to “test drive” the Power Gauge today. Get started right here.