The government locked its own citizens in their apartments for nearly two months…

At this point, we’ve all seen the news out of China. The country’s COVID-19 “zero tolerance” policy is nearly absolute. And it has angered almost everyone…

Residents of China’s two largest cities, Beijing and Shanghai, were stuck inside their homes. And in protest, some folks would scream or bang pots and pans on their balconies at night.

It’s shocking to American sensibilities. But China’s ruling class chose that path to fight COVID-19. And in the end… that path created a colossal mess for international logistics.

After all, Shanghai is the world’s largest shipping port. In fact, six of the world’s 10 biggest ports are in China. And it’s seven if you include Hong Kong.

Disruptions at these ports mean disruptions to the global supply chain. It’s just that simple.

To that point, most folks probably didn’t think about the global supply chain all that much before COVID-19. But they sure as heck do these days.

And now, Wall Street is tipping its hand. It’s looking to sop up money from this newfound interest in the global supply chain…

Two major providers recently launched logistics-focused exchange-traded funds (“ETFs”). But the thing is, they’re constructed much differently.

And importantly, this different construction is translating to different performance. If you’re looking for opportunities to invest in logistics today, you don’t want to confuse these ETFs…

The U.S. Global Sea to Sky Cargo Fund (SEA) began trading in mid-January. And then, the ProShares Supply Chain Logistics Fund (SUPL) launched in early April.

As its ticker implies, SEA mostly focuses on ocean shipping. It’s full of companies you’ve likely never heard of. They’re mostly foreign companies, too. Its top seven holdings are…

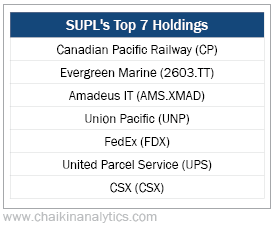

On the other hand, SUPL takes a broader approach to the supply chain. Railroads and domestic shippers dominate its top seven holdings. You’ll likely recognize many of them…

Importantly, Wall Street is showing us its hand with these ETFs…

The providers behind SEA and SUPL hope for a home run as folks track the latest twists and turns of the global supply chain. They’ve launched these ETFs at the peak of retail interest. And I’m sure they would love if folks start to see logistics as a “must hold” investment.

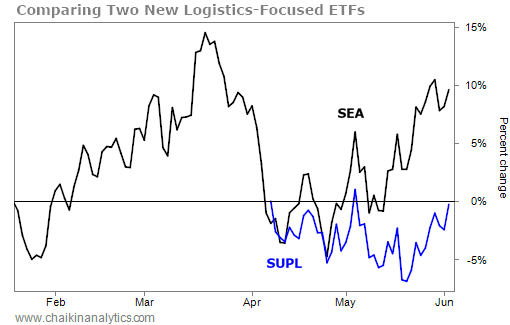

But when it comes to performance, the paths of these two ETFs diverge. Take a look…

As you can see, SEA is up roughly 10% since it launched in mid-January. And SUPL is around breakeven since its early April inception.

That performance speaks to the truly different focuses of the two ETFs.

As I said, SUPL’s top holdings are packed with railroads and domestic shippers. Casual investors might recognize them. But that doesn’t mean they’re always good investments.

On the other hand, SEA is heavily weighted to foreign ocean shippers you’ve never heard of. But importantly, they’re companies that the world needs to fix its supply-chain woes.

So from my perspective, SEA better fits the COVID-19 logistics narrative. It’s the more attractive opportunity as the world works to solve its current supply-chain bottleneck.

If you’re looking to jump into the logistics trade… don’t confuse these two ETFs.

Good investing,

Carlton Neel