Seventy-two million Americans can’t be wrong… At least, that’s what the market has taught us.

I’m a Boomer. I’m one of the millions of people born in that post-World War II period between 1946 and 1964.

Famously the largest generation in American history, we’ve long been used to our needs and preferences driving the national economy. What we bought, ate, and wore mattered. The things we did created huge economic momentum. Companies that catered to us prospered. So, too, did their stocks.

But we have to get used to a hard fact… A new force is dominating the economy and pushing our influence aside.

As of July 1, 2019, millennials took over as the largest living generation. The U.S. Census Bureau says 72.1 million Americans were born between 1981 and 1996. That edges out my cohort, which numbers 71.6 million people.

The U.S. Bureau of Labor Statistics forecasts that by 2030, millennials will make up about 44% of the workforce.

We, as investors, can ride this “Millennial Monsoon”… and the Power Gauge says we should.

Specifying a particular generation’s traits is a delicate task. It’s easy to lapse into lazy stereotypes…

But if we look at the numbers, a clear profile of this young generation emerges…

Millennials are highly educated. More than a third of them have college degrees, according to the Pew Research Center. That’s a higher percentage than any of the four preceding generations enjoyed at the same point in their lives.

But that education came at a cost. Millennials struggle with loads of student debt. Credit bureau Experian reports that the average millennial is dragging around nearly $40,000 in student loans. And Bank of America says that those student debtors are spending 10% of their monthly income on those debts.

The data also tell us that these folks are not rushing to marry, have children, or buy homes… at least, not at the same rate as previous generations. But they are trying to pursue healthy lifestyles. And they prefer spending money on travel and “experiences.”

Global indexing company Indxx translates themes like that into stock-selection criteria and builds indexes off them. Researchers there studied millennials. And they scored companies based on how millennial-focused they are in areas such as education, employment, fitness, travel, entertainment, housing, food preferences, and financial services.

They put the highest-ranking companies into their Indxx Millennials Thematic Index. The Global X Millennials Consumer Fund (MILN) offers a portfolio based on this index.

At present, Uber Technologies (UBER) and Meta Platforms (META) are the biggest holdings in this index. Each account for about 3.8% of assets. Netflix (NFLX) and Amazon (AMZN) are next, each at about 3.5%. Chipotle Mexican Grill (CMG), at 3.4% of assets, rounds out the top five holdings.

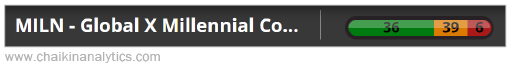

The Power Gauge is “very bullish” on MILN.

And its Power Bar – which compares the number of high-ranking stocks to those ranked “neutral” or worse – is very strong.

Given MILN’s emphasis on big growth names, it surged during the pandemic. From April 1, 2020 through its November 8, 2021 peak, it rose 142%. That beat the S&P 500’s 90% rise.

Then, it fell hard. MILN dropped 43% from its peak through the end of 2022. (That was worse than the S&P 500, which fell only 18%.)

Now, MILN seems to be recovering. So far this year, the fund has outpaced the bull market. It’s up 23% so far in 2023 versus a 15% gain for the S&P 500.

The Power Gauge has been very accurate in anticipating the fund’s ups and downs. Over the past five years, MILN’s annualized average return on days when the Power Gauge rated it “bullish” or better is 22%. On “neutral” days, it has averaged 17%. And on “bearish” or worse days, it has lost an average of 18%.

The “Millennial Monsoon” is only starting to build to full strength… and investors of any age would be wise to put their money to work in stocks that get swept up in that trend.

Good investing,

Marc Gerstein