When a lot of football teams get a big lead over their opponents, they stop trying to score…

Instead, they run plays that are likely to drain the most time off the clock.

That’s good sportsmanship.

But not every team does that. Some keep trying to score – again and again and again.

That’s what happened in the 1940 NFL championship game. Chicago ran the score up against Washington. And the Bears set an NFL record with a 73-0 victory.

Sportsmanship isn’t just about sports, either. Treating others the right way is important in everyday life as well.

It’s time for the Federal Reserve to see that.

The central bank is fighting the good fight against inflation. It has made a series of moves to slow the economy. More specifically, it started hiking interest rates in March 2022…

The Fed has pushed interest rates a lot higher since then. The benchmark federal-funds rate has risen from effectively zero in March 2022 to more than 5% today.

The Fed’s plan is working, too…

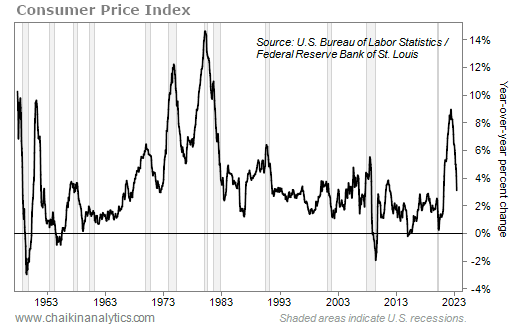

One of the best ways to track inflation is the Consumer Price Index (“CPI”). It peaked at around 9% in June 2022. But last month, the CPI came in at 3.1%.

And yet, some Fed officials want to keep running up the score…

Fed Chair Jerome Powell and a couple of others aren’t ruling out further rate hikes. After nudging rates up again last week, Powell reiterated the Fed’s desire to get inflation to its intended target of 2%.

But that would be bad sportsmanship.

As I’ll explain today, the Fed has already won the game…

Don’t just look at the latest CPI tallies. That would be like only looking at the part of the scoreboard that shows what has happened in the latest minute of the game.

Instead, we need to look at the full scoreboard. We need the results of the entire game.

Let’s do that with the CPI going all the way back to the late 1940s…

If you only look at the far-right side of the chart, you might think the Fed can still lose the game…

The CPI has dropped from around 9% to about 3%. But it’s still not at the Fed’s 2% target.

We need to look at the entire “game”…

With the full picture, we can see that the CPI’s post-pandemic deceleration is rare.

A similar move has only happened a handful of times since 1948. And for the most part, the move has related to an unusual shock in the system. It happened after…

- The Korean War in the early 1950s,

- The oil embargo in the early 1970s,

- Further oil-market woes in the late 1970s,

- The mortgage crisis about 15 years ago, and

- The COVID-19 pandemic in 2020.

It’s also worth noting that the CPI’s drop “lagged” behind the Fed’s first rate hike this time…

The Fed first hiked the fed-funds rate in March 2022. And yet, inflation continued to rise for a few more months. It didn’t peak until June 2022 at nearly 9%.

So even if the Fed stops hiking rates today, the CPI might still fall to 2% in the months ahead.

Before we move on, look again at the above chart. Notice how many times CPI growth came in at or near today’s 3.1% level. Also, notice how rarely it has come in at or below 2%.

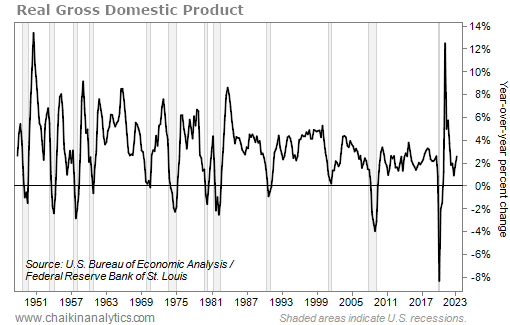

Now, look at the chart below. It shows the year-over-year percentage changes in inflation-adjusted, or “real,” gross domestic product (“GDP”) going back to the late 1940s. Take a look…

Again, take in the whole “game” instead of the most recent action. Run your eye from the most recent 2.6% gain in the second quarter of 2023 back throughout history.

Here’s my point…

Nothing in the second chart suggests the economy can’t be healthy with inflation above 2%.

The 1940 Bears didn’t need to score 73 points. And the Fed doesn’t need 2% or bust. It has already won the war against inflation.

So in the end, Wall Street is right to act as if the Fed won’t keep raising rates.

All the Fed needs to do now is graciously let the game clock expire.

Good investing,

Marc Gerstein