We all want the lights to go on when we flip the switch…

We all want to be cool when we turn on the air conditioner in the summer…

And we all want to be warm when we turn on the heat in the winter.

Put simply, we all want electrical products to work as they should. Otherwise, our daily lives would be much harder.

For that, we all need a reliable power grid.

On August 15, I highlighted an attractive opportunity in the Global X U.S. Infrastructure Development Fund (PAVE). The exchange-traded fund (“ETF”) still earns a “very bullish” rating from the Power Gauge.

But today, let’s take our analysis a step further. We’ll do a “deep dive” into one of PAVE’s holdings…

This holding only makes up about 0.3% of the ETF. But just like every single stock within PAVE, it also receives an individual rating from the Power Gauge.

And right now, it earns a “very bullish” rating…

MYR Group (MYRG) is a small-cap play in the electric-infrastructure space.

The company operates two business units, but transmission and distribution (T&D) is its bread and butter. This segment contributes about 70% of MYR Group’s operating profit.

In that segment, MYR Group works with utilities as a primary contractor. About half of its revenue comes from multiyear agreements. That’s important… It tells us that the company will have “sticky” business for years to come.

Bidding activity in this segment is brisk. In fact, the future looks bright due to a huge growth opportunity in the years ahead…

I’m talking about the shift to “renewables.” No matter your personal beliefs, you can’t deny that our country is trending toward relying on more renewable energy moving forward.

And MYR Group is perfectly positioned to take advantage of this shift…

You see, the Midcontinent Independent System Operator (“MISO,” for short) released plans to invest $10.4 billion for wind, solar, and battery storage. This independent, not-for-profit, member-based organization focuses on major T&D projects – MYR Group’s bread and butter.

Much of MISO’s work will go to incumbent utilities. That’s a plus for MYR Group. It already counts many of those utilities as customers.

Bidding opportunities also abound for MYR Group’s commercial and industrial segment…

This segment includes traffic-light networks, as well as lights for bridges, roadways, and tunnels. Airports, hospitals, data centers, hotels, stadiums, and more all fit into this category as well.

Frankly, it’s a lot to take in. And no matter how optimistic the outlook, it can be challenging for investors to sort out the narrative from a stock’s potential performance going forward.

That’s why I love having the Power Gauge at my side…

The system is every investor’s best friend. It breaks down every company using 20 individual factors. And then, it combines everything into an actionable overall rating.

So with that in mind, let’s see what the Power Gauge shows us about MYR Group today…

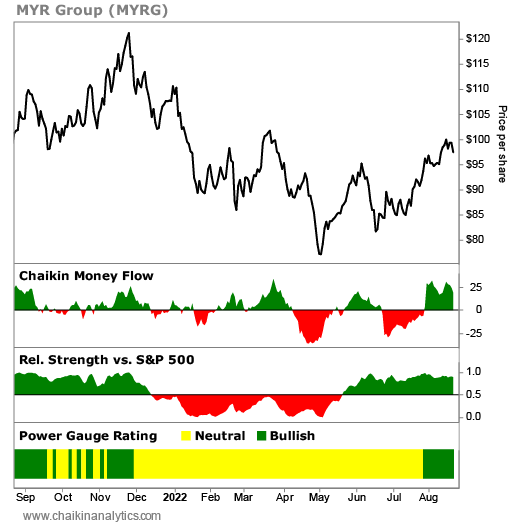

You might recall from our previous analysis that the Chaikin Money Flow indicator showed an influx of “smart money” for PAVE in recent weeks. The same thing is true for MYR Group.

Plus, as you can see, the company’s stock is outperforming the broad market over the past few months. And after a long stretch of “neutral”… it recently turned “very bullish.”

We can dig even deeper by looking into the rankings of individual factors…

Many companies with attractive business prospects have already been discovered by the market. Therefore, they have lackluster rankings for valuation-related factors.

However, MYR Group ranks “bullish” for price-to-sales (P/S) ratio. The company’s P/S ratio is about 0.6 today. In comparison, the S&P 500 Index’s median P/S ratio is 3.9.

The company also rates “bullish” for return on equity. That tells us profitability isn’t a promise for the distant future. It’s already here.

Finally, the “bullish” grade for long-term debt to equity indicates that the company is keeping a lid on business risk. That’s what we want to see with an investment.

These are just a few of the 20 individual factors the Power Gauge tracks. But as you see, we already have a wealth of actionable information available to us…

We know that the smart money favors this company. It’s outperforming the broad market. And it’s rated “very bullish” overall, based on the proprietary weighting of its 20 factors.

That’s the beauty of the Power Gauge.

Good investing,

Marc Gerstein