I love it when the Power Gauge produces surprising results…

And folks, that’s exactly what we’re seeing today.

You see, one specific sector is hated in a high-interest-rate environment. If you don’t know it immediately, it’ll be obvious as soon as I mention it…

Real estate.

After all, higher rates mean higher payments on property loans. And that leads to higher total costs over the lifetime of the loan.

That puts a huge damper on purchasing. And that’s playing out in the housing market today.

Sales of new single-family homes peaked in August 2020. That was more than two and a half years ago. And today’s number is roughly 34% below the peak.

Without question, rising rates are a headwind for the real estate sector.

Despite that, one subsector related to real estate is soaring right now. In fact…

It’s the No. 1 subsector in the Power Gauge today.

This subsector has doubled the performance of the S&P 500 Index so far this year. And judging from the Power Gauge’s “very bullish” rating, we can expect more gains ahead.

So let’s get into it…

If you haven’t guessed already, we’re looking at the homebuilders subsector today.

We track that subsector in the Power Gauge through the SPDR S&P Homebuilders Fund (XHB). This exchange-traded fund (“ETF”) holds mega homebuilders like PulteGroup (PHM), D.R. Horton (DHI), Lennar (LEN), and more.

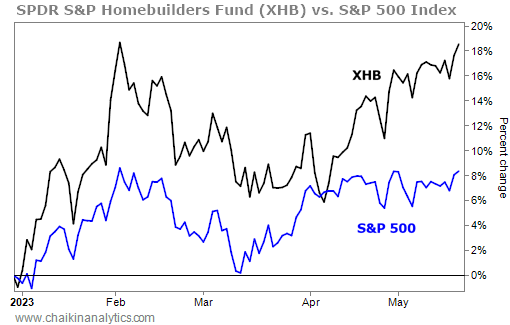

Since the start of 2023, the ETF has more than doubled the performance of the S&P 500. It’s up around 18% over that span, while the S&P 500 is up about 8%. Take a look…

Now, that might come as a surprise to some folks. But regular Chaikin PowerFeed readers know that my right-hand man and analyst Briton Hill wrote about this topic yesterday.

Put simply, high rates didn’t wreck the housing market in the 1970s. And they’re not wrecking it today.

In fact, by nearly all estimates, the U.S. housing market is still incredibly undersupplied…

Recent estimates indicate that the U.S. housing supply is around 6.5 million homes short. And even with a surge in multifamily and single-family buildings, we’re still years away from closing that gap.

Now, 2008 might seem like a distant memory for most of us. But macroeconomic trends take a long time to unfold. And the U.S. spent years building too few homes in the wake of the housing crash and ensuing financial crisis.

So it’s no surprise that homebuilders are soaring today. The fact is, a major amount of homes still need to be built. That means business will keep booming for these companies.

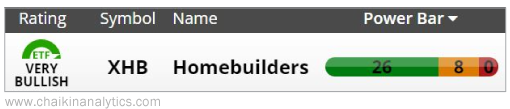

The Power Gauge sees that, too. It currently ranks XHB at the top of its list of subsectors…

XHB is “very bullish” today. And its Power Bar breakdown is firmly in the green zone…

You can see that the ETF currently holds 26 “bullish” or better stocks. And it doesn’t have any “bearish” or worse holdings.

In other words, the Power Gauge sees continued potential for XHB in the coming months.

I realize that I might sound like a broken record. After all, readers with a sharp memory will recall that I already highlighted this subsector in early April.

But that’s exactly my point…

Since then, XHB has climbed roughly 6%. Meanwhile, the S&P 500 is only up about 1%.

The outperformance from homebuilders is clear. And the Power Gauge is “very bullish.”

So if you haven’t already, take a look at this top-performing subsector today.

Good investing,

Marc Chaikin