Rising interest rates won’t crash the housing market…

There, I said it. And it probably sounds a little crazy. But hear me out…

Most industry experts will tell you that rising rates are putting pressure on housing prices. And they’re right that housing prices have pulled back in some areas.

But in the past, interest rates have been far higher than they are right now. And during that period, housing outperformed nearly every other asset class.

It’s true.

Let’s get to the details…

In short, I’m talking about the 1970s and early 1980s.

Inflation ran rampant back then – even worse than today. And interest rates surged…

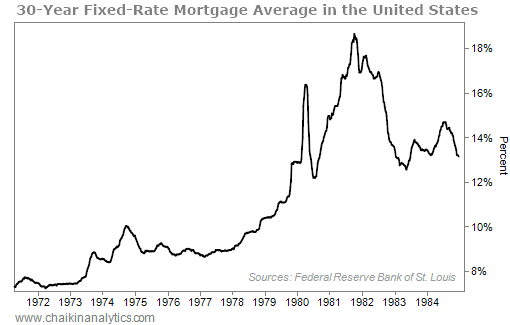

They rose all through the 1970s. As you can see in the following chart, the 30-year mortgage rate peaked at nearly 19% in October 1981…

That should’ve devastated the housing market, right? After all, double-digit interest rates made it expensive for folks to pay their home loans. And that should’ve wrecked demand.

Not so fast.

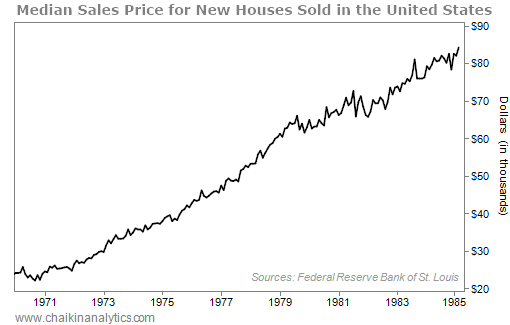

Take a look at this chart of U.S. home prices over the same period…

As you can see, housing prices rose steadily throughout the 1970s. And this uptrend happened in spite of mortgage rates being three times higher than they are today.

In 1970, the median home price was $22,100. By 1980, the price had nearly tripled to $62,900. That’s an annualized rate of return of roughly 11%.

Clearly, housing wasn’t crushed by rising interest rates. And the reason why is simple…

Uncle Sam stepped in with numerous federal programs to prop up housing – especially for low-income families. Congress passed the Equal Credit Opportunity Act and the Community Reinvestment Act.

The government also created tax subsidies – like Section 121, which allowed for a $100,000 one-time exclusion in capital gains for sellers 55 years or older. And it later increased the exclusion to $125,000 in 1981.

These subsidies nurtured a resilient housing market. And today, we’re starting to see the federal government step in again…

For example, a few weeks ago, the Federal Housing Finance Agency announced mortgage applicants with low credit scores would receive a break on their fees. And you can bet that plenty more subsidies are coming down the pipeline.

For millions of people, homeownership defines the American Dream. Uncle Sam will do his best to protect that.

I bet on real estate and rising interest rates with my hedge fund last year. People thought I was crazy… Some of my investors wanted me ousted. They didn’t want to believe the data.

But I stuck to my guns, and it paid off. I returned 9.3% for my investors.

That might not seem like much, but it was much better than the S&P 500 Index. The benchmark stock index fell around 19% over the same period.

Here’s my point…

You’ll hear a lot of “fear” rhetoric about housing in the mainstream media these days.

That can cause investors to make emotional, irrational decisions. And it can lead them into even poorer investment choices.

Don’t fall victim to the fearmongering. Stay positive. And remain “bullish” on housing.

Good investing,

Briton Hill