Take a quick guess…

What’s the most hated sector in the market right now?

If you said “real estate,” you’re right.

Real estate is currently one of only two “bearish” sectors in the Power Gauge. And it’s in last place in terms of the Power Bar ratio…

Only one of the 30 holdings within the Real Estate Select Sector SPDR Fund (XLRE) is rated as “bullish” or better in the Power Gauge. And 17 of XLRE’s holdings are “bearish” or worse.

The market agrees with the Power Gauge’s “bearish” take, too…

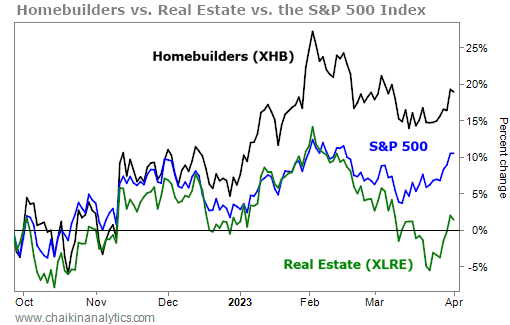

XLRE is underperforming the benchmark S&P 500 Index so far this year. Over the past month alone, it has lost more than 4%. Meanwhile, the S&P 500 is up nearly 2% in that span.

And of course, most investors know that higher interest rates are brutal for the real estate sector. The reason is simple…

Higher rates raise the cost of doing business. Loans – and most importantly, loan payments – get more expensive. And finding profitable opportunities becomes harder.

So it’s no surprise that the real estate sector is suffering.

But as I’ll show you today, the story is drastically different in a related corner of the market. In fact, it’s so shocking that I believe most investors are simply ignoring this situation.

The Power Gauge is always watching, though. And right now, it’s “very bullish” on this surprising subsector…

Folks, I’m talking about the SPDR S&P Homebuilders Fund (XHB).

If XLRE is the commercial side of the business, then XHB is the consumer side.

XHB is packed full of companies that build the homes that everyday Americans buy. I’m talking about companies like D.R. Horton (DHI), PulteGroup (PHM), and Lennar (LEN).

And recently, XHB is doing much better than the real estate sector as a whole…

It’s up more than 19% over the past six months. It’s beating the S&P 500 by around seven percentage points in that span. And it’s crushing XLRE by a lot more. Take a look…

It’s easy to see the considerable strength behind homebuilders on the chart. And the Power Gauge sees more opportunity ahead as well…

You see, our system is much more optimistic about homebuilders than the real estate sector. It currently points toward many great opportunities within this subsector…

According to the Power Gauge, 22 of XHB’s holdings are rated as “bullish” or better. And this exchange-traded fund includes zero “bearish” stocks.

Now, I realize that might seem crazy to you…

After all, we’re in a high-rate environment right now. The popular narrative is that the real estate rally is over. And a lot of people are still calling for a major wipeout in this sector.

But we can’t ignore the data…

Now that rates are settling, existing-home sales are starting to rise again. They climbed 14.5% in February. That’s the largest month-over-month increase since July 2020.

Put simply, demand is still in place. But prices are still high…

As I wrote a couple months ago, 28 million Americans think they’ll get a $100,000 discount off the current median home price. That’s nothing more than a fantasy…

Most Americans are struggling to afford homes at today’s prices and rates.

Now, you can hope for falling prices. But I wouldn’t hold my breath for that outcome…

Aside from the 2008 housing crisis, there’s very little historical precedence for falling home prices. So that can only mean one thing…

Supply needs to increase. And that’s good news for homebuilders.

The Power Gauge sees that – even if it’s not a popular narrative right now.

Good investing,

Marc Chaikin

P.S. The Power Gauge also helped me see that a powerful market indicator just triggered…

In short, this indicator has only appeared a handful of times since 1950. And every time, it has predicted the stock market’s next move – with a 100% success rate.

Ignoring this signal could spell disaster for your money this year. That’s why I recently sounded the alarm for as many folks who would listen. At least today, you can still watch the event replay right here.