Editor’s note: The markets and our Chaikin Analytics offices will be closed Monday, September 5, for Labor Day. Because of that, we won’t publish the Chaikin PowerFeed e-letter. Look for your next issue on Tuesday, September 6.

Everyone wants to believe the market is near a major bottom…

But unfortunately, as our founder Marc Chaikin showed on Wednesday, the market isn’t out of the woods yet.

The Federal Reserve is still fighting inflation with higher interest rates. And its impatience with “lags” could ultimately throw us into a lengthy recession.

As a result, “risk” remains at the top of many investors’ minds.

Many exchange-traded funds (“ETFs”) are based on risk-reducing “factors”…

A factor is simply a characteristic that signals future stock outcomes. And right now, with risk aplenty, ETFs based on factors like quality and low volatility are very alluring.

The quality factor is usually defined using return on equity (“ROE”) or other valuation ratios. That’s in part because high-ROE companies tend to be more stable – and higher quality.

Think of low volatility as quality’s cousin…

With this factor, investors don’t look directly at quality. Instead, they seek stable share-price behavior. (That usually happens with high-quality companies.)

But today, the question is… do these factors outperform a strategy of simply buying “what’s working” in stocks? In other words, could we do better with a guide like the Power Gauge?

Quality and low-volatility stocks shouldn’t drop as much as others during bad times. After all, that’s the point of investing in these ETFs.

And so far in 2022, they’ve worked well…

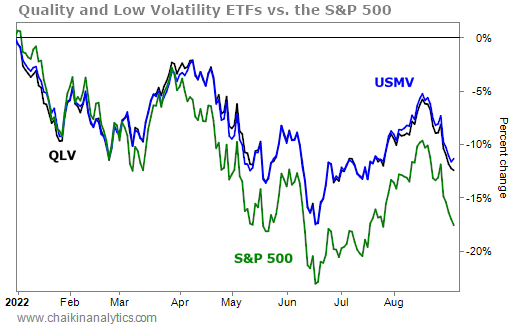

The chart below shows how two of these ETFs and the S&P 500 Index have performed this year. The FlexShares U.S. Quality Low Volatility Index Fund (QLV) and the iShares MSCI USA Minimum Volatility Factor Fund (USMV) haven’t fallen as much as the S&P 500…

So far, so good. Quality and low-volatility stocks are outperforming in a rough market.

But in the long term, it doesn’t always happen that way…

Lower risk is expected to produce lower returns.

Real-life oddities can sometimes produce unexpected outcomes, of course. However, even if you aren’t a quant, you can still recognize that sort of tradeoff.

Protection from risk is a valuable service. Therefore, one should pay for it.

That’s true in life. We all pay to insure our health, our home, our car, and so forth.

And it’s true in the markets as well…

I’ll spare you the math. But even with individual stocks, you have to pay up for quality. And paying higher prices often acts as a drag on returns.

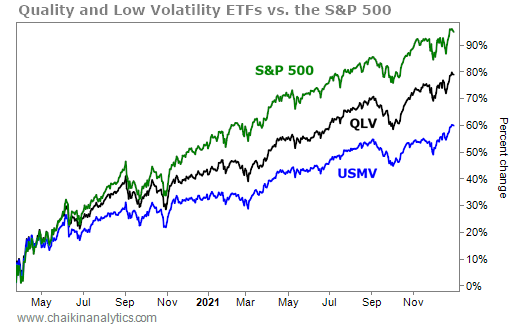

That’s what happened with these two ETFs from the March 2020 bottom through the start of this year. The market was mostly strong. And while they did well, they underperformed the S&P 500 by a wide margin. Take a look…

Investors who followed the quality and low-volatility playbook didn’t do as well. Prioritizing these two factors suppressed the bull market returns for those folks.

Fortunately, investors can employ a better risk-management solution…

I’m talking about our Power Gauge system.

On the surface, the Power Gauge’s use of factors makes it seem similar to these ETFs. But a huge conceptual difference exists…

You see, academic quants are creatures of math and statistics. So their factors come from many past studies. Statistical support dictates which factors are used.

By contrast, the Power Gauge is a creature of the stock market. Its factors come from our founder Marc Chaikin’s 50-plus years of real-life market experience.

Marc based the Power Gauge on how he and other successful investors make decisions. He researched and tested. But that alone isn’t enough… A Power Gauge factor also needs to make sense in the context of the markets.

With the Power Gauge as your guide, you can manage risk by “rotating” into and out of sectors (using stocks or ETFs). And importantly…

By focusing on sectors that the Power Gauge favors, you can do much better than investing in factor-based ETFs.

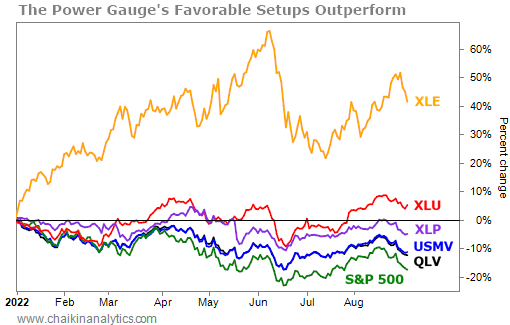

For example, the Power Gauge has ranked the Energy Select Sector SPDR Fund (XLE), Consumer Staples Select Sector SPDR Fund (XLP), and the Utilities Select Sector SPDR Fund (XLU) favorably for most of this year. And look at how they’ve performed…

These three ETFs have all outperformed the S&P 500, QLV, and USMV. Energy is the big winner. But it’s also clear that utilities and consumer staples are “what’s working” today.

The Power Gauge helps us see that.

And the thing is… when “what’s working” changes, the Power Gauge will help us see that as well. It’s the perfect way for us to maximize our gains, regardless of the overall market.

In other words, factor ETFs are fine. They can work as intended when times get tough. But the Power Gauge shows us an even better way to thrive – in good and bad times.

Good investing,

Marc Gerstein

Editor’s note: Chaikin Analytics founder Marc Chaikin issued an urgent warning for investors earlier this year… just weeks before the S&P 500 plunged into a bear market.

Now, he’s back with a critical market update…

In short, Marc believes a massive opportunity is underway in a special group of U.S. stocks. And folks could potentially see multiple 300% to 500% winners over the long run.

But at the same time, what’s coming could also wreck your portfolio if you ignore it.

You’ll want to find out straight from Marc about what’s happening, as well as exactly how to position your money to reap the rewards. Watch his latest presentation right here.