Her interview shenanigans didn’t sway Warren Buffett…

The CNBC host had more than implied that we might be in for another major financial crisis. She asked the 93-year-old billionaire a series of questions during their April 12 interview…

Is this a banking crisis? Is this financials in turmoil? Is this Banking Crisis 2.0? What would you call what we’ve been seeing happen?

The host was angling for a “run for the hills” response. But Buffett saw through her tactic…

Sure, some West Coast and specialty banks had blown up. However, he didn’t see the coming contagion that the media was furiously pushing. As part of his response, he noted…

They have mismatched assets and liabilities. And bankers have been tempted to do that forever. And every now and then, it bites them in a big way.

Notably, though, Buffett wasn’t interested in entertaining any end-of-the-world scenarios.

The news cycle runs at warp speed these days. So I’ll forgive you if you’ve moved on.

But folks, we witnessed a major financial event this year. I even publicly predicted it…

You may recall my messaging around a coming “run on the banks.”

Like Buffett said on CNBC, I saw that many banks had “mismatched assets and liabilities.” And in our world of rising interest rates, that made a financial fallout nearly guaranteed.

In early March, Signature Bank and Silicon Valley Bank collapsed. First Republic Bank joined them in early May. And the federal government had to step in to help clean up the mess.

JPMorgan Chase (JPM) ultimately took over First Republic’s deposits. And the Federal Deposit Insurance Corporation untangled the obligations of the other two failed banks.

In the end, the banking system absorbed roughly $548 billion in assets from the banks.

Not surprisingly, stocks in the banking industry tanked…

At Chaikin Analytics, we use the SPDR S&P Bank Fund (KBE) to track this space. From its most recent high this past February through its low in early May, KBE plunged nearly 37%.

And it was even worse than that. KBE had lost roughly 47% from its January 2022 peak.

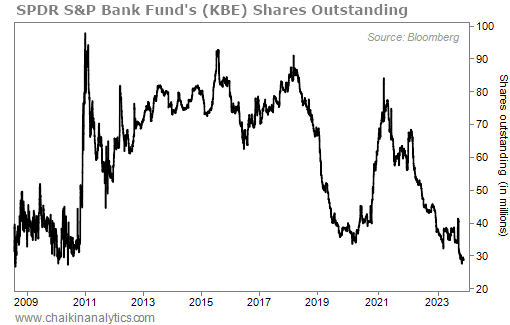

Folks, one of America’s most important sectors suffered a historic wipeout earlier this year. And we can clearly see that investors treated it that way. Look at the following chart…

That’s what we call “shares outstanding” for KBE. In other words, it’s the number of shares of the exchange-traded fund (“ETF”) in the market at any given time.

You see, the folks who manage ETFs “create” shares by buying the stocks they hold. And they “eliminate” shares by selling the shares of their underlying stocks.

Notice that KBE’s shares outstanding are at their lowest point in more than a decade. That tells us the banking industry just went through one of the most extreme periods of outflows in recent history.

But as we noted earlier, Buffett thought this shift was pretty run-of-the-mill. And I agree…

In America, banks take risks. Sometimes, they “mismatch assets and liabilities.”

That doesn’t mean every banking shakedown will evolve into a 2008-style crisis.

A 2008-style crisis is the exception – not the norm. And importantly, for investors like us, situations like our current one can lead to incredible opportunities.

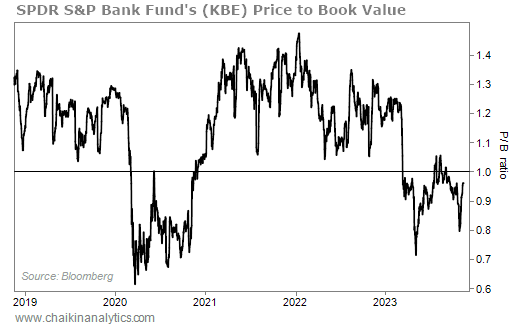

Look at the next chart…

This chart tracks the price to book value (P/B) of the underlying index behind KBE. As you can see, the ratio is less than 1 right now.

That’s a critical development. Think about it…

Banks make money on their book value. They use their assets to generate profits.

That makes the P/B ratio one of the most important measures for this sector. And today, the data shows that this entire group is undervalued.

The Power Gauge sees the current upside in this space. It’s currently “bullish” on KBE.

Plus, three weeks ago, my colleague Vic Lederman noted that the Power Gauge had turned “bullish” on the SPDR S&P Regional Banking Fund (KRE) as well. That’s still the case.

So if you’re not already paying attention to this space, I recommend you do so today.

Good investing,

Marc Chaikin

P.S. You’re invited to my urgent briefing next week…

In short, the Federal Reserve holds the fate of the U.S. stock market (and your retirement) in its hands. And you need to start preparing before the central bank makes its next move.

Nothing is more important for your money heading into 2024. That’s why I hope you’ll set aside some time to join me next Wednesday, December 6, at 8 p.m. Eastern time.

And just for tuning in, you’ll get four FREE recommendations. Click here to learn more.