Last November, I shared a major prediction at a special Chaikin Analytics online event…

It probably felt like “too much” for many investors.

At the time, I said that “a major shift in our financial system… could lead to a run on the banks in 2023.”

Now, I didn’t know that this situation would involve Silicon Valley Bank. And I didn’t realize that folks would rush to clean out their bank accounts.

I didn’t expect the situation to unfold exactly like this. Nobody could have.

But last fall, it was clear that rising interest rates and low-yield bank accounts were changing the landscape…

I expected a lot of money to start flowing out of banks. And I expected it to start flowing into areas where investors could earn a higher rate of return.

That’s just basic economics.

It also seemed obvious that the situation could worsen and cause market volatility. And of course, that’s exactly what has happened since last November.

Even though we can’t predict specific market outcomes, we can still look for clues…

As I’ll explain today, the Power Gauge was watching the banks the entire time. And it saw what many financial experts and investors didn’t…

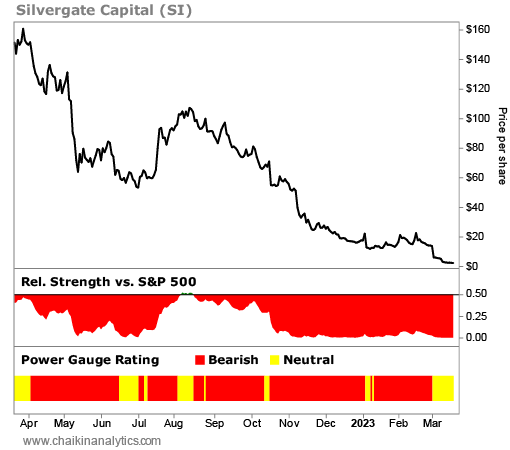

Silvergate Capital (SI) was the first domino to fall. Two weeks ago, the crypto-focused bank announced a plan to wind down its operations.

Look at Silvergate’s performance over the past year…

Pay close attention to the Power Gauge rating at the bottom of this chart…

The different-colored bars show the rating for Silvergate on any given day over the past year. Broadly speaking, yellow is “neutral” and red is “bearish.” (And green is “bullish.” But in this case, that rating doesn’t apply.)

You’ll notice that the Power Gauge flipped to red (“bearish”) for Silvergate on April 5, 2022. And it has been either “bearish” or “neutral” since then.

In fact, the Power Gauge warned us about all the troubled banks throughout last year…

Our system flashed a “bearish” sell signal on First Republic Bank (FRC) on April 1, 2022. And it flashed “bearish” sell signals on Signature Bank (SBNY) and Silicon Valley Bank’s parent company, SVB Financial (SIVB), on July 11 and July 25, respectively.

In other words… the Power Gauge alerted users to sell (or avoid) all these bank stocks long before they collapsed.

Folks, this is exactly why I built the Power Gauge…

It’s my life’s work. I’ve put everything I learned in my 50-year finance career into it. And now, the system is able to help everyday investors thrive in any environment.

In the end, I don’t pretend to know exactly what’s coming next for the markets…

But with the Power Gauge at our side, we can pinpoint major shifts like a run on the banks. And we can do it before most investors even begin to figure out what’s happening.

Good investing,

Marc Chaikin

P.S. Many investors are on edge right now – and for good reason…

The recent wave of bank collapses completely changes the investing road map for 2023.

This could be the most important turning point of my career. Now, a short window is in place that could lead to bigger gains than anything we’ve used the Power Gauge for before.

I’ll explain all the details in a FREE online event next Tuesday night, March 28. Plus, just for tuning in, you’ll get the name and ticker symbol of a company on my “buy” list for 2023. Sign up right here.