This year’s banking crisis scared the heck out of many Americans…

A few, mostly unknown regional banks collapsed in the first few months of 2023. And as the story unfolded, we learned more about their dangerous and tangled bets.

But if you’re a regular Chaikin PowerFeed reader, you likely weren’t caught off guard…

Chaikin Analytics founder Marc Chaikin warned last fall that a “run on the banks” would make waves in our economy. And the Power Gauge was alongside Marc the whole time…

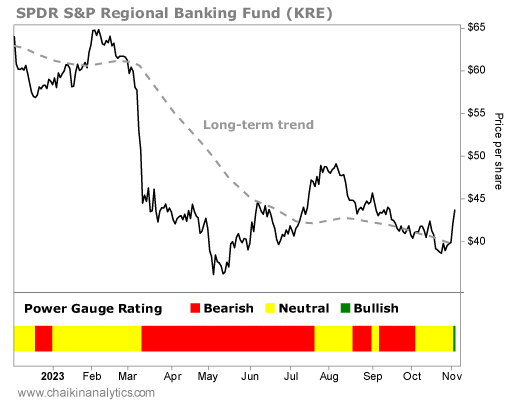

Our one-of-a-kind system flipped to a “bearish” rating on the broader SPDR S&P Regional Banking Fund (KRE) in December 2022. That was months before the collapse unfolded.

The Power Gauge even flashed early warning signs on the three regional banks that suffered catastrophic wipeouts (Silicon Valley Bank, First Republic Bank, and Silvergate Capital).

But as we near the end of 2023, things look a little bit different in this subsector. In fact…

The Power Gauge just flashed a “bullish” signal on regional banks.

This change is worth a closer look. And as you’ll see, we’re not the only ones who’ve noticed…

It feels like the entire financial world is ripping apart at the seams today. Sky-high interest rates have slowed lending. And a lot of banks seem to be teetering on the brink of disaster.

But the Power Gauge just made a big change on regional banks. Take a look…

As you can see in the bottom panel, the Power Gauge just turned “bullish” on KRE last week. Plus, the exchange-traded fund is now trading above its long-term trend.

Now, I don’t blame you if you don’t think this chart is super convincing. It’s clear that we’re on the early side of a potential turnaround in this space.

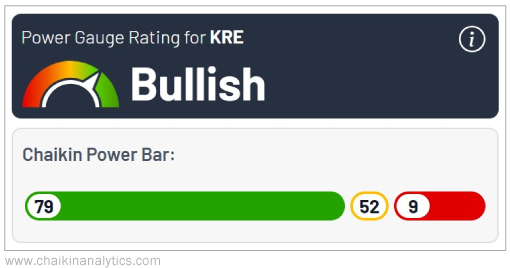

But if you need more proof that change is underway, look at the following Power Gauge snapshot. It’s the Power Bar ratio for KRE. Notice that it’s overwhelmingly green right now…

That’s right…

Most of the 140 rated stocks within KRE now receive “bullish” or better grades in the Power Gauge. And only nine of these stocks earn a “bearish” or worse rating.

That’s a remarkable shift for an industry that many folks abandoned earlier this year.

I get it if you’re still hesitant when it comes to regional banks. After all, we all lived through three of the worst four bank failures in U.S. history not that long ago.

But I want you to know that the Power Gauge isn’t alone in seeing this change…

You see, legendary investor Bill Gross just announced a major bet on regional banks last week as well. And notably, three of the four individual stocks he bought are KRE holdings.

In case you don’t know, Gross is known as the “Bond King.” He co-founded investment-management firm PIMCO in the early 1970s. And he ran its $270 billion Total Return Fund through 2014.

At age 79, Gross has seen just about every battle that you can imagine in the bond market.

No one is better equipped than Gross to make a broad assessment on regional banks.

So today, it’s incredible to see the Power Gauge shifting right alongside him.

Yes, we might be a little bit early on an opportunity in regional banks. But the Power Gauge has spotted the change. And so has one of Wall Street’s most famous money managers.

I recommend paying close attention to how this shift unfolds in the days and weeks ahead.

Good investing,

Vic Lederman