Editor’s note: We’re once again turning the Chaikin PowerFeed over today to Joel Litman…

Joel is the founder and chief investment strategist of our corporate affiliate Altimetry. And this essay previously ran in his Altimetry Daily Authority e-letter on November 7.

In it, Joel discusses how millennials’ savings are now running out. Their debt is rising because of high interest rates. Even worse, student-loan payments have resumed.

But as you’ll see, another generation is thriving in our high-rate environment. In the weeks and months ahead, Joel believes stocks in the sectors tied to this generation will shine…

Millennials have taken punch after punch from high interest rates…

Like most Americans, they had extra money saved up during the pandemic.

They received the same stimulus checks as everyone else. And some even had the bonus of delayed student-loan payments, saving them an extra couple hundred bucks each month.

As we saw, with almost everything shut down, there wasn’t much to spend money on.

So they saved and saved.

Over the past few years, though, millennials used those added savings for extra expenses…

Once the economy opened back up after the pandemic, they splurged. They went out to eat, spent money on new clothes, bought big-ticket items, and were part of the huge “revenge travel” trend.

Now, what savings millennials had left are starting to run out. The debt they took on is adding up due to high interest rates. Their credit- and debit-card delinquencies are on the rise. And many are facing the resumption of student-loan payments.

This generation is finally being forced to rein in their spending. And in turn, the sectors of the economy they typically support are hurting.

On the other hand, high interest rates have been a boon for one generation…

Baby Boomers.

As I’ll discuss today, Baby Boomers have had plenty of time to build up their asset bases. And thanks to high interest rates, they have a healthy amount of savings, too. So the best way to play today’s market is by investing in stocks that cater to the older generation…

Millennials are getting squeezed, while Baby Boomers are raking in cash.

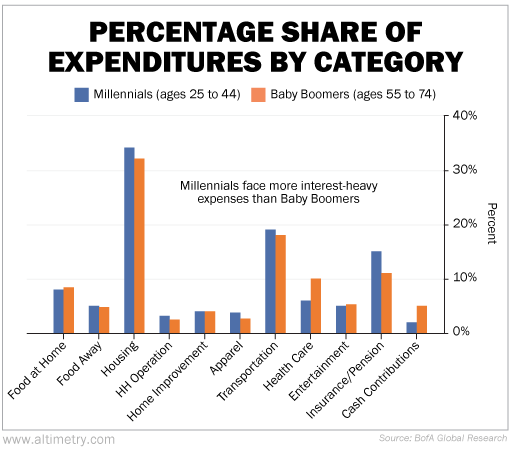

According to data from Bank of America, millennials spend a lot more on things like housing, transportation, and retirement compared with Baby Boomers.

Baby Boomers more frequently own assets like houses and cars outright, meaning they’re not nearly as much of an expense. In fact, nearly twice as many Baby Boomers own their homes outright compared with millennials. That means they don’t have to worry about how interest rates might change mortgage or rent costs.

On top of that, as Baby Boomers get to the end of their careers and retire, they don’t have to worry about putting money into retirement or pension plans. They’ve had a full career to save away. And now, they have money to spend or invest.

Take a look…

This trend has led to a huge split in the way millennials and Baby Boomers view high interest rates…

On the one hand, millennials largely depend on debt to pay for homes, cars, and even college tuition. Higher rates make those expenditures more expensive and harder to pay off.

Credit- and debit-card delinquencies are already rising among millennials. And the longer rates stay elevated, the more that generation will have to tighten its purse strings.

As we said earlier, that’ll likely hurt the industries that cater to them – like retail. Millennials spend more on apparel than Baby Boomers do, so this industry will probably feel some pain.

Meanwhile, Baby Boomers’ savings have gotten a major boost from higher interest rates. Savings accounts are yielding more today than they have in two decades.

As a result, Baby Boomers haven’t had to hamper their spending. They now account for the bulk of U.S. consumption.

And the sectors they spend the most in stand to benefit. Industries like health care, entertainment, and travel – where the older demographic tends to spend more money – are likely to do well.

According to Bank of America, when it comes to discretionary spending, travel ranks highest on the list of priorities for Baby Boomers. Cruise lines especially see a large crowd of Baby Boomers, who make up roughly 40% of their guests.

Above all else, health care might be the biggest and most important spending category for the older generation.

Baby Boomers spend significantly more on health care than millennials do.

And recession or not, that spending isn’t flexible. The older you get, the more you need to spend on taking care of your health.

So today, it’s a great idea to focus on what Baby Boomers are buying…

Eventually, “millennial stocks” will bring fantastic investment opportunities. As the largest generation, it has the numbers to drive spending in certain sectors of the economy.

As we’ve covered, though, we’re unlikely to see a pickup in millennial spending right now. Interest rates are weighing too heavily on millennials’ pockets and their mountains of debt.

We’re in a golden era for Baby Boomers. They have more cash to spare. And their spending could rise even further with the Federal Reserve expected to keep rates elevated.

“Boomer stocks” – like those in the health care, travel, and entertainment industries – will likely do well as a result.

Regards,

Joel Litman

Editor’s note: Joel believes the era of easy money is now over. And the only way to avoid it is to put at least some of your money to work in the one place where high inflation, high rates, and high prices can’t take it from you…

U.S. stocks.

Tonight, at 8 p.m. Eastern time, Joel and I (Marc Chaikin) will host a special event to discuss everything. We’ll reveal a group of “Perfect Stocks” that have high earning potential and low risk. To find out how to make money in the new year, click here to learn more.