Apple (AAPL) is making moves behind the scenes to prepare for a downturn…

In short, Bloomberg reported earlier this week that the tech giant plans to freeze hiring in some divisions. Apple intends to be cautious on spending through next year as well.

And the thing is, Apple isn’t alone…

In recent weeks, many companies have started to tighten their belts. For example, in late June, Meta Platforms (META) founder Mark Zuckerberg bluntly said during a Q&A session…

Realistically, there are probably a bunch of people at the company who shouldn't be here… [And] I think some of you might decide that this place isn't for you, and that self-selection is OK with me.

Now, we’re talking about two of the world’s largest companies by market cap. And their decisions have ripple effects throughout the rest of the economy.

Put simply… one company’s expenses are another company’s revenues.

If Apple trims its expenses, the stocks of companies related to those expenses will likely start to fall. And the company’s hiring freeze could slow down consumer spending across the board. After all, unemployed people tend to spend less.

Investors are hunkering down, too. That’s clear on Apple’s price chart.

Today, we’ll revisit a warning I sounded about Apple a couple months ago. And after the latest news came out, you’ll see that the next phase of this breakdown just played out…

On May 16, I noted that Apple would likely fall even further after the stock fell below a key “support level” of $150 per share. And that’s exactly what happened…

Apple closed as low as $130.06 per share on June 16. That was roughly 12% below its May 13 close price of $147.11 per share (the final trading day before my essay).

Since that happened, $150 per share is now what traders call a “resistance level.” It’s the psychological price level that the stock needs to break through to find upward momentum.

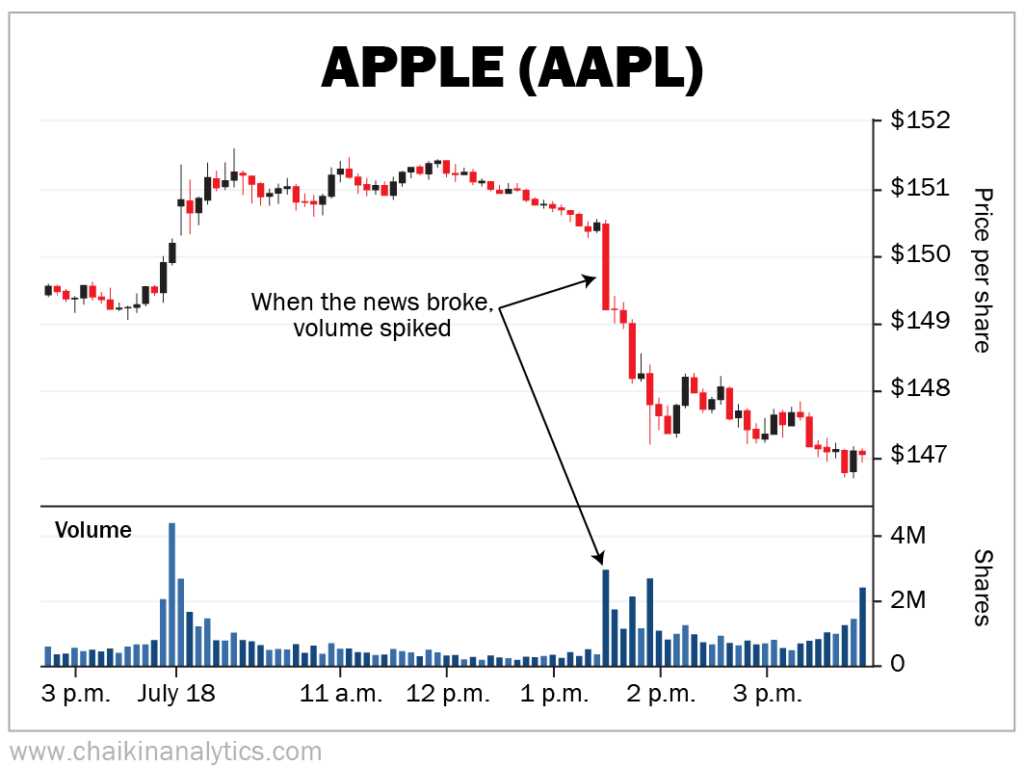

On Monday afternoon, Apple’s stock was right at $150 per share – and attempting to climb higher. Then, the news broke about the company’s hiring freeze and belt-tightening plans.

The news was first published at about 1:30 p.m. Using Apple’s five-minute chart from that day, we can see that investors reacted immediately…

Notice that volume spiked as soon as Bloomberg published its story. And within minutes, the stock dropped right through the $150-per-share resistance level yet again.

Apple’s economic warning shot was loud and clear for investors. It signaled that “things are going to be rough going forward.”

That matters when we’re talking about the world’s largest company…

Apple makes up a huge percentage of the major indexes. For example, it accounts for 7% of the benchmark S&P 500 Index and 13% of the technology-focused Nasdaq 100.

In short, Apple is the last general standing. It’s the spot where the so-called “smart money” parks a lot of its capital as it waits out the market gyrations.

But this latest round of bad news caused concern among investors. And the $150-per-share resistance level held true.

Today, Apple is testing that level yet again…

The stock closed yesterday at $153.04 per share. That’s above resistance. But remember, Apple just fired its economic warning shot. The markets are still trying to process it.

If Apple stock starts to pull back further, expect the downtrend to continue. But if it can stay above $150 per share, it will tell us that a bit of optimism remains in the market.

Of course, it could also be a “head fake” to the upside. After all, it’s a critical level. Folks who buy Apple at more than $150 per share might only get faked out if it turns lower again.

So in the end, we should keep a close eye on Apple for now. Its next move is crucial. And if you already own shares, be sure to protect yourself with a solid exit strategy.

Good investing,

Pete Carmasino