The market was standing on an apple crate of sorts… And it just broke.

You see, Apple’s (AAPL) stock just crossed below a critical threshold. The tech giant closed last Wednesday at less than $150 per share.

That’s important because of Apple’s size. In January, it became the first publicly traded U.S. company to surpass $3 trillion in market cap.

More specifically, I’m talking about its representation in the world’s largest stock indexes. Apple accounts for roughly 7% of the entire S&P 500 Index. That’s huge.

When you drill down into tech stocks, it gets even crazier…

Apple is the top-weighted stock in the tech-heavy Invesco QQQ Trust at more than 12%. And it makes up more than 22% of the Technology Select Sector SPDR Fund (XLK).

In short, that means Apple’s influence on the markets is much bigger than any ordinary stock. When Apple struggles, it brings the entire market down along with it.

Today, I’ll show you what Apple dropping below a critical threshold means. And more importantly, we’ll look at what it could mean for the markets going forward…

Some market observers scoff at technical analysis. But I’m a big proponent…

I’ve spent more than 30 years in finance. And I’ve learned from some of Wall Street’s biggest names.

During that time, I’ve realized a simple truth… The price action of a market or a specific company is the sum of all available information.

You might also recall that “when” matters more than “why” in technical analysis. We covered that idea on April 25 with our breakdown of XLK’s recent struggles.

Ultimately, a stock’s price action represents the emotional state of all market participants. Because of that, key psychological levels support or resist change at any time. Traders refer to these key levels as “support” and “resistance.”

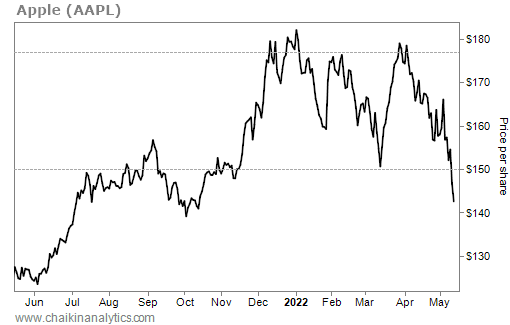

Put simply… if you want to know how the market is feeling, look at the chart. And when it comes to Apple, the chart is painfully clear today. Take a look…

It’s easy to see that Apple just broke below support at $150 per share. That was the key psychological level. And now, the stock is headed for new lows.

The next stop down is a long way off. The second level of support comes into play around $120 per share – or about 18% from its current price.

And below that, the pre-pandemic high of $80 per share is the last support level. That’s roughly 45% lower than Apple’s current price.

If investors “hit the reset button” and trade Apple’s stock back to that spot… we’re in for a world of pain.

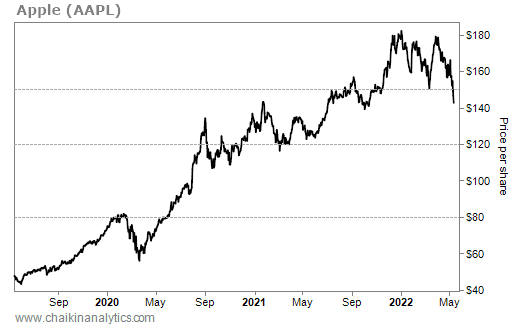

When we zoom out to a longer-term chart, these key levels are easy to see…

Apple’s recent breakdown is significant because of the company’s size. The stock just fell through a critical support level. And its struggles can bring down the whole market.

So as I said, the market was standing on an apple crate of sorts… And it just broke.

Our takeaway is simple…

Always be aware of the risks facing the market. When major players like Apple are falling through key support levels, it’s extremely hard for the overall market to move higher.

In the end, it’s crucial to plan for what could happen… rather than wonder what did happen after it’s too late. As I’ve said before, the “when” matters more than the “why.”

Be sure the investments you make account for this harsh reality.

Good investing,

Pete Carmasino