Editor’s note: If you’re still worried about the market making record highs…

Don’t be.

The Power Gauge remains “bullish” on U.S. stocks today. And as we’ve said time and again so far this year, stocks hitting new highs doesn’t mean a crash is imminent.

You also likely know that we aren’t the only ones who see more upside ahead…

We’ve shared similar insights from our friend Brett Eversole. As regular readers know, Brett is the editor of the True Wealth franchise at our corporate affiliate Stansberry Research.

Today, we’re again turning the Chaikin PowerFeed over to Brett…

This essay first appeared in his free DailyWealth e-letter last Thursday, March 14. In it, he explains why he expects stocks to keep rising in the coming months…

The poster child of the artificial-intelligence boom blew away investors once again…

A few weeks ago, Nvidia (NVDA) announced another round of fantastic earnings. And it managed to outpace the already ambitious estimates from investors.

Shares rallied 16% the next day. And Nvidia added more than $250 billion to its market cap.

It has continued to rally over the past few weeks. In fact, the stock is already up nearly 80% in 2024. And that comes after its 239% rally in 2023.

You might worry that the stock has moved too far, too fast.

Even worse, you might fear that the overall market is on shaky ground. You might think that the massive outperformance of a few mega-cap stocks is hiding a weakening bull run.

It’s a reasonable fear. But once you dig deeper, you’ll see that’s not a big concern…

You see, most stocks are moving higher right now – not just a few. And it means the market’s uptrend will likely continue…

Nvidia’s blowout earnings are making it feel like 2023 all over again.

The so-called “Magnificent Seven” soared last year. And as you’ll recall, this group of stocks accounted for most of the gains in the overall market.

These tech titans have gotten so big and so important that a lot of folks are worried. Typically, if only a few mega-cap stocks are rising – and everything else is falling – it’s a terrible sign for the market.

But we’re not seeing that today…

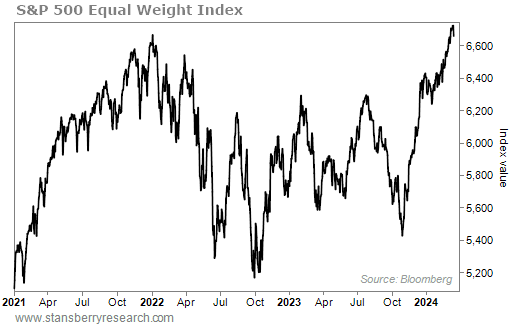

One way to see the breadth in the current rally is through the S&P 500 Equal Weight Index.

This index gives powerful insight into the overall market’s health. Instead of weighting stocks by their market caps – like the S&P 500 Index normally does – it gives each stock the same weight.

For example, the Magnificent Seven stocks make up a staggering 29% of the S&P 500 today. But they make up just 1.4% of the Equal Weight Index.

If only the largest stocks rally, then the Equal Weight Index won’t move higher. But that’s not the case today. As you can see, this index is near an all-time high as well…

Most stocks are rallying right now.

What’s more, the Equal Weight and S&P 500 indexes have already been hitting new 52-week highs together. That means stocks will likely keep rallying in the months ahead.

To see it, I looked at how the overall market performed after every instance of this combination going back to 1991. Take a look…

The market goes through ups and downs. But it’s a great long-term vehicle for building wealth. The S&P 500 has typically returned 8.6% per year since 1991.

We can do even better when both the S&P 500 and Equal Weight indexes hit new 52-week highs at the same time, though. That setup has led to 5.8% gains in six months and 10.9% gains over the following year.

The consistency of these gains is impressive, too. Stocks were higher 82% of the time after six months and 89% of the time after a year.

That trend tells a compelling story…

The biggest companies might be getting all the headlines right now. Just look at Nvidia’s blowout earnings. The report certainly got a lot of attention.

But the Magnificent Seven aren’t the only stocks rallying today.

Most of the market has been rising.

This rally is healthy. And according to history, it’s wise to own stocks right now.

Good investing,

Brett Eversole

Editor’s note: We’ve occasionally featured insights from DailyWealth. But if you don’t already receive this e-letter, you’re missing out…

Brett and his colleagues share insights on the day-to-day opportunities they see in the markets. And they help their readers safely – and steadily – build a lifetime of wealth.

Just like the PowerFeed, you can receive DailyWealth for free. It’s delivered in the morning each weekday that the markets are open. Learn more about it and sign up right here.