Wall Street loves acronyms and catchy nicknames…

About a decade ago, TV personality Jim Cramer wanted a way for his viewers to easily remember a key group of stocks. So he used the first letter of each company’s name…

The four stocks were Facebook, Amazon (AMZN), Netflix (NFLX), and Google. Facebook and Google, of course, now go by Meta Platforms (META) and Alphabet (GOOGL), respectively.

Just like that, the acronym “FANG” was born.

It later evolved to “FAANG” as Wall Street experts added Apple (AAPL) into the mix.

When the FAANG stocks start moving lower, the markets can’t help but take notice…

For example, my colleague Vic Lederman called out a slump for Apple a few weeks ago. As the tech giant’s stock started selling off, the Power Gauge switched to a “neutral+” rating.

The Power Gauge still views Apple the same way. And as I’ll explain today, the system recently flipped its rating for another FAANG stock to “neutral+” as well…

You don’t need to be Jim Cramer to realize that this group of stocks is a big deal…

The FAANG stocks make up nearly 28% of the tech-heavy Nasdaq 100 Index. And the broad market S&P 500 Index has a roughly 17% weighting in these five companies.

Last October, I wrote about an upside change in one of the FAANG stocks – Netflix.

At the time, I looked back one week to see the relative performance of the FAANG stocks…

I noticed that Netflix was the top performer among its peers. And even better, the stock was also outperforming the S&P 500. So I highlighted it as a developing opportunity.

Netflix closed around $268 per share on the day before I wrote about the stock. Today, it trades for about $370 per share. That’s a roughly 38% gain in less than a full year.

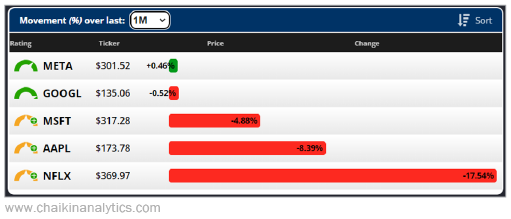

But today, the opposite is happening. You can see what I mean in the following graphic…

The graphic shows the one-month performance of all the FAANG stocks through midday trading yesterday. Netflix is down nearly 18%. All the others are doing better than that.

In other words, Netflix is underperforming its peers today.

The technical picture is dwindling as well…

Our relative strength indicator is now in a negative trend. And the Chaikin Money Flow indicator is deep in the red. That tells us the “smart money” is running away from Netflix.

Folks, the Power Gauge updates daily…

It analyzes 20 different factors. It weighs each one to produce an overall rating for every stock in its universe. And our technical overlay alerts us if the time isn’t right for a stock.

The system is flashing a caution sign with this FAANG stock today. Be careful.

Good investing,

Pete Carmasino