Two campers are walking through the woods. Out of nowhere, a grizzly bear appears…

The first camper starts to run. The second camper shouts ahead to the first camper that they’ll never outrun the bear. It’s too fast.

That’s when the first camper reveals his true goal…

He tells the second camper that he isn’t trying to outrun the bear. He’s only trying to outrun him.

That is “relative strength”…

It can be relative to a benchmark (like the bear). Or it can be relative to a peer (like the second camper).

When it comes to stocks, the idea of relative strength is simple…

We want to find the best stocks in the market that are beating their benchmark or their peers. That’s one of the fundamentals to building a successful track record as an investor.

Let me show you what I mean…

At Chaikin Analytics, we focus on relative strength versus the S&P 500 Index. And more specifically, we use the index-tracking SPDR S&P 500 Trust (SPY) as our benchmark…

The first step to success is finding stocks that are relatively better than SPY. And the real key is finding them at the best entry points. That way, we can maximize our returns.

To do that, we also need to know which sectors to be in – and if the stock has good fundamentals as well. That’s where the Power Gauge comes in…

Our one-of-a-kind system measures 20 different factors. It includes valuation ratios – like price to sales and price to book value.

But it also measures things like Wall Street analysts’ ratings and insider buying. These types of factors are much harder for individuals to find and process effectively.

That’s why we let the Power Gauge do the hard work for us.

In the long run, we’re looking for stocks with good fundamental and technical setups. But sometimes, special situations lead us to focus on certain factors (like relative strength).

Here’s a recent example…

Everyone knows streaming-media juggernaut Netflix (NFLX).

Netflix’s stock traded sideways for most of August and September. Its share price during that time was essentially stuck in a channel between about $220 and $250 per share.

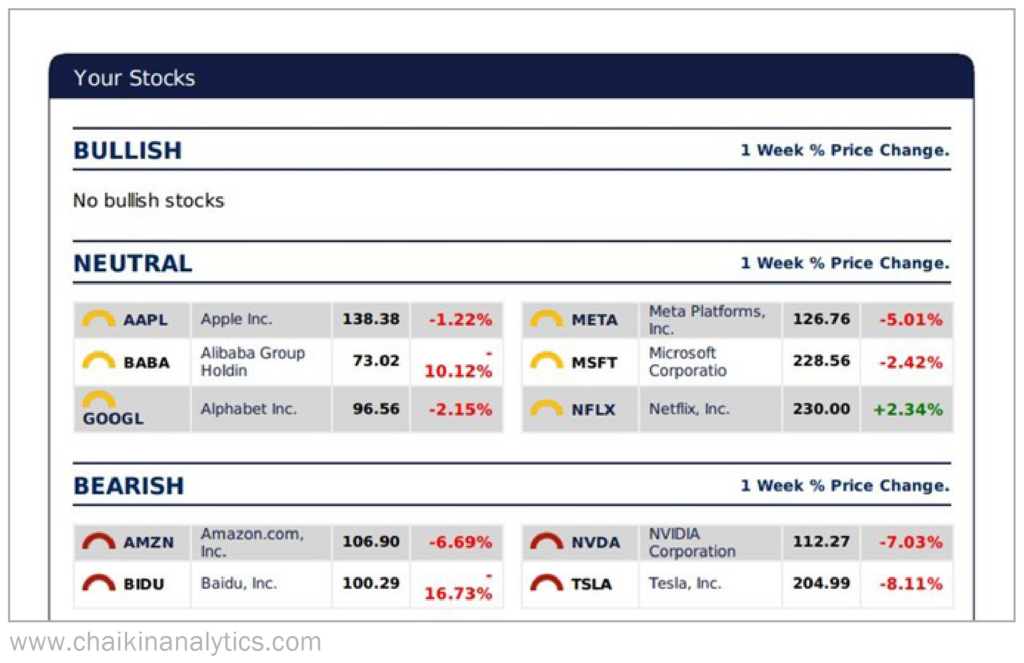

But then, during the week of October 10, something important happened. You can see what I mean in one of the stock screens I use for my research…

Notice that Netflix performed relatively strong compared with its peer group that week. It beat out companies like Microsoft (MSFT), Apple (AAPL), Meta Platforms (META), and Alphabet (GOOGL).

It also outperformed SPY, which lost about 1.4% that week. And importantly, Netflix’s stock held up on down days in the broad market.

Netflix’s relative strength was signaling something important. The stock was trading on a different narrative than the broad market. And after the markets closed Tuesday, we found out why…

In short, Netflix released a strong earnings performance. The company added 2.4 million subscribers in the third quarter. That increase blew away expectations.

As a result, Netflix’s stock soared more than 13% on Wednesday.

But the thing is… with relative strength, we already knew a big move could happen.

Folks, relative strength is an important tool for investors like us. It allows us to spot changes in a stock’s performance – especially changes that diverge from the crowd.

During the week of October 10, Netflix signaled to us that it was the faster camper. And in situations like that, it’s critical to run with the fastest camper we can.

We don’t want to be the second camper who falls behind and gets eaten by the bear.

Good investing,

Pete Carmasino