Apple (AAPL) just unveiled its newest line of iPhones…

The tech giant held its traditional annual event in California on Tuesday. And as always, the main attraction was the iPhone 15 and its siblings (like the top-line iPhone 15 Pro Max)…

The iPhone 15 Pro models weigh less than the previous versions because they’re made of titanium instead of stainless steel. The phone’s camera sensor is better, too (and now more in line with the rest of the industry).

And I can’t forget that Apple updated the iPhone’s charging port.

Seriously…

The biggest news this year was that Apple finally ditched its proprietary Lightning connector.

Of course, the company tried to spin the change as its own great idea. But if you follow the tech scene, you know it didn’t have a choice…

European regulators passed a long-awaited mandate last October. In Europe, all new cellphones are required to use USB-C chargers by the end of 2024.

Sure, Apple presented everything at the event in its usual grandiose style. A lone speaker on a dimly lit stage breathlessly described each new feature.

But this year, the event came across as uninspired. And in the end, the market wasn’t impressed. Apple’s stock fell 1.7% on Tuesday.

As I’ll explain today, it’s about more than just one bad day…

Apple is down around 11% from its peak in late July. And the Power Gauge is no longer “bullish” on the company. Our system is telling us to tread lightly…

Apple is once again making headlines with its latest iPhone. But the real question is…

What does the data show us?

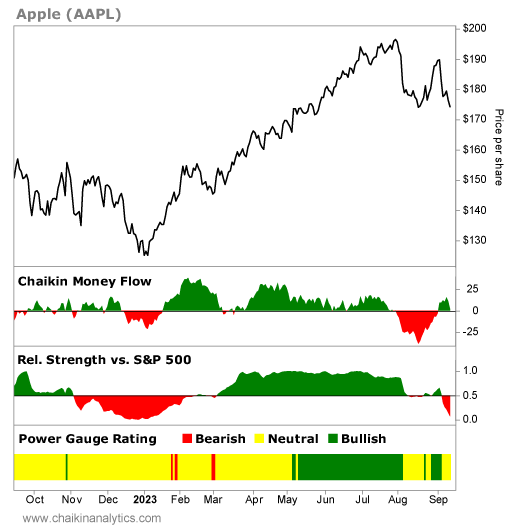

According to the Power Gauge, Apple isn’t as “bullish” as it was earlier this year. Take a look…

First things first, Apple has absolutely soared this year. It’s up roughly 35%.

But it’s easy to see on the chart that something has changed recently. In fact, this change started a couple months ago. And the Power Gauge was on top of everything…

Look at how the Chaikin Money Flow indicator sputtered out in late July. That tells us the so-called “smart money” wasn’t buying at the same pace as it did earlier this year.

Plus, we see another problem for Apple…

The company’s relative strength versus the S&P 500 Index also faltered in August. That means it was – and still is – failing to outperform the benchmark index.

After crunching all that data, the Power Gauge is now flashing a sign of caution…

Apple earns a “neutral+” overall rating today. In other words, our system is telling us that Apple is a good company that’s struggling in the market right now.

The Power Gauge obviously didn’t know the iPhone 15’s launch would be ho-hum.

But it did look at the mountain of data on Apple’s struggles. It could see that the smart money turned against the stock. And it could tell that its relative strength is weakening.

In the end, the Power Gauge realizes that something is up with Apple right now.

I recommend watching this one closely in our system.

After all, Apple is the top holding in the S&P 500 and other major indexes – like the tech-heavy Nasdaq 100 Index. So its performance can tell us a lot about the overall market.

Good investing,

Vic Lederman