In June, I told a group of my paid subscribers that they “haven’t missed the energy boom.”

We’ve already closed the position I recommended that month for a roughly 14% gain. And last month, we booked a 38% return with another leader in the energy space.

Now, I’m not telling you all that to brag. The fact is, we’re in a very challenging market. And I believe nearly every portfolio has suffered under the tough conditions.

Even with the market rallying in recent days, the S&P 500 Index is still down about 20% this year. And the tech-heavy Nasdaq Composite Index remains down around 30% in 2022.

That makes the energy sector all the more intriguing…

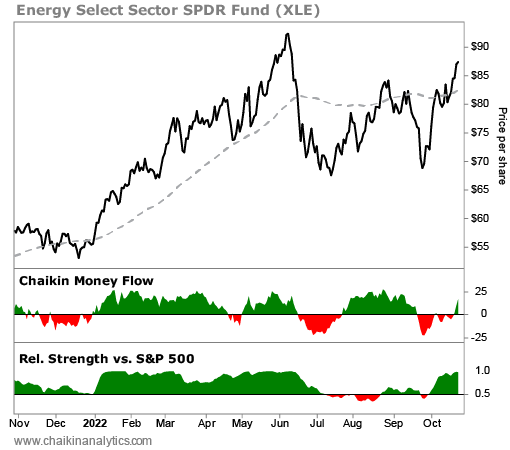

You see, the Energy Select Sector SPDR Fund (XLE) is up roughly 60% so far this year. That’s an absolutely massive return – especially given the broad market’s struggles.

However, XLE also fell as much as 27% from its 52-week high. And that high happened all the way back in June. So today, I want to help you answer a simple question…

Is the energy sector still a safe bet?

Let’s see what the Power Gauge says…

Folks, I’ll get right to the point…

XLE, our proxy for the energy sector, currently earns a “very bullish” overall rating from the Power Gauge. And it’s pretty easy to see why on the chart…

After a brief correction, XLE went right back into its uptrend. In fact, it’s up a staggering 29% in the last month alone.

Next, I want to draw your attention to the “relative strength” panel below the main chart. Notice that XLE’s relative performance dipped below the S&P 500 starting in July.

In other words… despite its huge run for the year, it started to sputter out over the summer. And it was performing worse than the broad market during that time.

Despite that, the Chaikin Money Flow indicator jumped back to positive (green) after most of XLE’s downturn. That tells us the so-called “smart money” saw the pullback as a buying opportunity.

And it paid off… As you can see on the chart, XLE is now outperforming the market again.

Also, most of the stocks in XLE with Power Gauge ratings are “bullish” or better today.

Specifically, 14 stocks in XLE earn a “bullish” or “very bullish” rating from the Power Gauge. Six earn a “neutral” rating. And only one earns a “very bearish” rating.

That’s about as good as it gets these days for a broad market sector like energy.

So to answer the question we asked ourselves at the outset…

Yes, energy still looks like a safe bet today. No, we haven’t missed the opportunity yet.

The energy sector is soaring. XLE is up 29% in the last month alone. And even after a cooling-off period over the summer, its 60% year-to-date performance is incredible.

But don’t feel like you’ve missed the boat. I expect further outperformance ahead…

XLE is currently outperforming the broad market. And if you look at the far-right edge of the Chaikin Money Flow panel in the above chart, you’ll see another uptick starting.

Put simply, you still haven’t missed the opportunity in energy. It’s still one of the only shelters from today’s market storm.

Good investing,

Marc Chaikin