Editor’s note: We introduced you to Brett Eversole in the Chaikin PowerFeed yesterday…

Brett is an editor at our corporate affiliate Stansberry Research. And like Chaikin Analytics founder Marc Chaikin, he’s starting to see reasons for optimism in the market right now.

As Brett explained yesterday, the inflation “boogeyman” will be dead within months. And today, he’ll show you why another common belief about the market is also dead wrong…

“We’ve never broken inflation without this happening…”

It became the rallying cry for market bears over the past year.

Inflation was the problem. And history pointed to a solution. But it was darn painful…

Interest rates had to go up. And they had to go up a lot. That’s because high inflation had never come down until the federal-funds rate was higher than the inflation rate.

This time last year, the fed-funds rate was 0%. But back then, inflation exceeded 7%.

That meant a lot of pain was on the way for investors. And it meant dramatically higher rates would force a reset on Wall Street.

Things have changed since then, of course. But not as much as you might hope…

Interest rates are still well below the inflation rate. So by following this line of thinking, you might expect plenty more rate hikes from here.

But as I’ll show you today… that line of thinking is dead wrong.

In fact, if you look at it the right way, the Federal Reserve has basically done its job. And it means the rate hikes that beat up the market in 2022 could already be a thing of the past.

Let me explain…

Yesterday, I explained the current trajectory of inflation. It has been heading lower for the past six months. And it has been doing so quickly.

If that trend continues, the Fed won’t have to hike rates much from here. In my view, one more rate hike is the likely outcome. And there’s actually an even more bullish possibility…

One measure tells us we might see zero rate hikes this year.

This measure is the “proxy funds rate” from the Federal Reserve Bank of San Francisco. And in short, it accounts for quantitative easing and quantitative tightening…

If the Fed is buying bonds, that’s additional easing. That means money is looser than the effective fed-funds rate shows. And if the Fed is selling down its balance sheet – like it is right now – it means money is tighter than the effective rate shows.

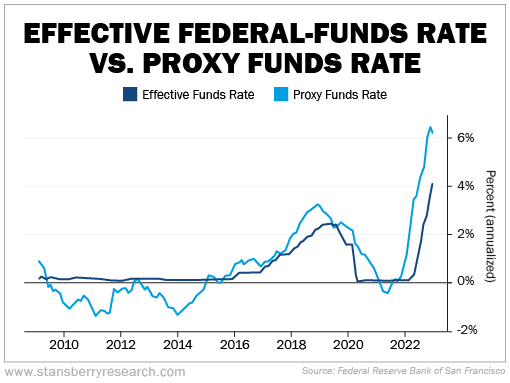

Here’s the proxy rate versus the effective fed-funds rate since quantitative easing began in 2009…

You can see that interest rates were set near zero after the global financial crisis. But because the Fed was buying bonds, the proxy rate was actually negative.

Today, the proxy rate is much higher than the effective rate of 4.25%. That’s because the Fed has sold down its balance sheet by roughly half a trillion dollars since last April.

The proxy rate is over 6% right now. That’s darn close to the seasonally adjusted inflation rate of 6.4% in December.

The Fed knows this. So given the high proxy rate and the fact that inflation growth is slowing down… the central bank’s rate hikes could be over.

That possibility – yes, just the possibility – is the most important financial shift of 2023…

Higher interest rates were truly the only thing that mattered for investors last year. But the seemingly endless hikes have either already found an end or will very soon.

That’s reason enough to be optimistic for the rest of the year.

So if you’ve been waiting to put money to work, the time is now.

Good investing,

Brett Eversole

P.S. The upside potential of 2023 is only a drop in the bucket of a larger trend that’s already underway. It’s one that the mainstream media has ignored to a staggering degree. But it’s the most important story for your money this year – and for many years to come.

My mentor, Dr. Steve Sjuggerud, is hosting an event TONIGHT at 8 p.m. Eastern time to share exactly what’s taking place. And best of all, it’s FREE to watch. You won’t want to miss this event and the shocking reset about to hit Wall Street. Click here to register.