Editor’s note: We’re doing something a little different in the Chaikin PowerFeed today…

As regular readers know, Chaikin Analytics founder Marc Chaikin recently detailed a rare extreme in market “breadth.” It leads him to believe a new bull phase could be here.

And he’s not the only person who’s getting more optimistic about stocks…

Brett Eversole is an editor at our corporate affiliate Stansberry Research. And as he’ll explain in this essay, one big headwind looming over the market could be gone soon…

The COVID-19 pandemic brought boring economic discussion to the forefront.

And it turned millions of Americans into armchair economists…

Inflation became a part of casual conversation as it hit the grocery stores. I’ve heard plenty of nonfinancial folks explain why the Consumer Price Index undersells reality – or why it’s a less useful measure today because of the lag in shelter data.

I love seeing people get more interested in finance.

But to me, there’s no need to get into the nitty-gritty of what makes up the monthly inflation data. We don’t have to zoom in that much to see what’s coming next.

Instead, we just need to understand where we are… where we’re likely headed… and how the Federal Reserve will view what’s coming.

Once we do that, a clear picture emerges. It tells me that the inflation “boogeyman” of 2022 will be dead by March. And that will set the stage for a massive market rally this year.

Let me explain…

First, let’s look at inflation’s current trajectory. After all, that’s what matters most…

The Fed hiked rates like crazy last year to try to get inflation under control. The effective federal-funds rate went from 0% at the start of 2022 to 4.25% at the end of the year.

A lot of folks expect those massive rate hikes to continue. And history shows that extreme inflation doesn’t usually fall until the fed-funds rate rises above the current inflation rate.

We’re not there yet. Not even close…

The December inflation data came out earlier this month. Year-over-year growth hit 6.4% on a seasonally adjusted basis. That’s down from the high of 9% last June. But it’s still well above the Fed’s 4.25% interest rate.

So if you’re like most folks, you might assume the Fed will have to keep hiking rates to tame inflation. But that logic is missing a key shift in trajectory…

Inflation growth began to slow dramatically last July. In the four months before that, it was up by an average of 1% month over month. But that average dropped to just 0.16% per month over the past six months. And the December data was down versus the prior month.

Overall, we’ve seen an 80%-plus reduction in month-over-month inflation growth. That’s why the year-over-year number keeps falling.

Now, with six months of low month-over-month inflation growth, it’s logical to assume that the declines will continue. And if they do, inflation will fall faster than almost anyone realizes.

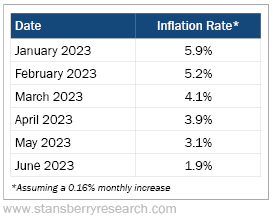

The table below shows the year-over-year inflation rate going forward, assuming the monthly increase remains at 0.16%. Take a look…

If the current trend continues, inflation is going to crater in the months ahead. It will be below 6% in January… down to 4.1% in March… and back to pre-pandemic levels by June.

This swift drop isn’t what the typical “man on the street” – or even many financial experts – would expect from here. But it’s the likely scenario given what we’ve seen in recent months.

And it has massive implications…

Remember, the effective fed-funds rate is 4.25% right now. That means the Fed has already hiked interest rates above the likely March inflation rate. That’s the key that most professionals look to as the time when the Fed will be able to ease its foot off the brakes.

So there’s a good chance we’ll only see one more rate hike. Then, the Fed can back off – potentially even cutting rates later this year.

This is far from the consensus view. But as you’ve seen today, it’s perfectly logical based on where things are headed at the moment. And it’s a powerful shift for investors…

The headwind that crushed the markets in 2022 will no longer be a concern. That will set the stage for massive stock market gains in 2023.

Last year, it was smart to be cautious. But the world has changed. And if you’re not positioned for a positive move in stocks this year, you’ll end up regretting it.

Good investing,

Brett Eversole

P.S. An even greater market shift is about to take place. This market reset will influence what happens with your money for the rest of this decade. And the story is so big that my colleague Dr. Steve Sjuggerud is breaking his nearly two-year silence to get the word out.

Steve is hosting a FREE event tomorrow night, January 31, at 8 p.m. Eastern time to share the full details. You’ll even get two stock ideas just for watching. Click here to register.