A travesty is playing out in the investing world right now…

“Safe havens” are disappearing.

U.S. Treasury bonds and gold are the most notable safe havens. For decades, investors could park their money in these assets… And they could often make modest gains with relatively low risk.

This blueprint worked perfectly for retirees… That’s because at that stage in life, folks are more concerned with protecting and living off their wealth than growing it.

But in our current market environment, these low-risk places to park money aren’t the same… And even worse, folks close to retirement don’t have many clear alternatives.

Let me explain…

In short, Treasury bonds and gold aren’t what they used to be.

Bonds have traditionally served as a good place for people on fixed incomes to park their money. Folks could sleep easy at night… Their money would be safe in the hands of the U.S. government, and it would earn some interest along the way.

But now, with inflation around 6%, any return less than that is a relative loss. And Treasury bonds haven’t gotten close to those types of returns recently…

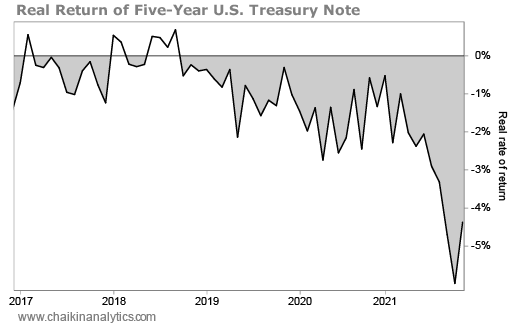

For example, the five-year U.S. Treasury note yields about 1.5% today. However, when you factor in inflation, the real rate of return on this note – the difference between its yield and the inflation rate – has been negative for most of the past several years…

In other words, inflation is eating up any returns in Treasury bonds today. (My colleague Pete Carmasino discussed this point in more detail in the December 23 PowerFeed.)

To make matters worse, the Federal Reserve announced plans to consider raising interest rates starting in March. Bond prices and yields are inversely correlated… When rates rise, prices drop.

So inflation and rising rates are two strikes against Treasury bonds as a safe haven.

Next, let’s consider what’s happening with another historical safe haven – gold…

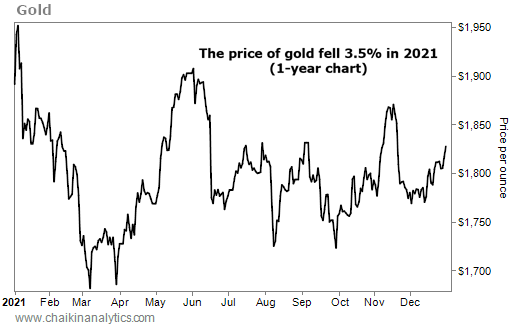

When inflation rises, investors often turn to the precious metal. It’s considered a steady place to store wealth in times of turbulence.

Despite that, studies published back in 2012 – a decade ago – call into question whether gold ever served as a good hedge against inflation. And its recent performance seems to support those doubts…

The precious metal’s value dropped 3.5% as inflation soared in 2021. Take a look…

With inflation hitting 40-year highs, you would think money would be running toward so-called safe havens like Treasury bonds and gold… But at least so far, it’s not.

The only obvious assets that held up in 2021 were real estate investment trusts and stocks… And they’re both a far cry from low-risk investments.

Folks, to me, it’s clear… No low-risk, modest-return vehicles remain. And unfortunately, the lack of safe havens could cause a lot of retirement problems in the near future.

That’s why now, more than ever, you need a focused investment strategy…

Investors will flee low- and negative-yield assets in the months ahead. And as long as the current market conditions persist, they’ll be looking for places to park their money.

We’re in for another turbulent year in stocks… But it’s one with considerable upside potential.

After all, with the death of safe havens, folks don’t have anywhere else to turn.

Good investing,

Karina Kovalcik