Editor’s note: The markets and our Chaikin Analytics offices will be closed tomorrow in observance of Christmas. Because of that, we won’t publish the Chaikin PowerFeed e-letter. Look for your next issue on Monday, December 27. And enjoy the holidays!

Folks, inflation is eating away at our spending power right now…

And there are few options for investors.

In fact, the Federal Reserve just took one supposedly “safe” option away…

As the central bank in the U.S., the Fed is responsible for maintaining its so-called “dual mandate”… It needs to ensure “maximum employment” along with “price stability.” Essentially, price stability is just a fancy way of saying it must avoid out-of-control inflation.

So with inflation soaring today, everyone is keeping a close eye on the Fed.

Fortunately, the Fed just told us what it’s going to do from here… But unfortunately for one group of investors, in the end, the central bank is basically telling them to pound sand.

Let me explain…

The Fed often pulls different levers in order to maintain its dual mandate. For example, as my colleague Carlton Neel explained on Tuesday, it takes part in “quantitative easing.”

In short, that’s when the central bank buys longer-term bonds from the open market. It’s a way to increase the money supply, which will ideally lead to more lending and investment.

But when inflation starts getting out of control like right now, the Fed must shift gears…

On December 15, the Fed said it intends to end its bond purchases in March. That will allow for a freer float of bonds in the markets… And then, the Fed will raise interest rates.

Why in that order?

It’s because of the relationship that bonds have with interest rates. You see, bond prices are inversely related to interest rates… When rates go up, prices drop – and vice versa.

So given that relationship, the Fed will gradually stop buying bonds… It will let the market set the prices naturally. Then, based on data points like inflation, unemployment, and even wage growth… the Fed will be able to assess when – and by how much – it will raise rates.

Remember, the end goal is to get inflation under control. But the Fed has to deal with tapering in the bond market first. Again, it’s proposing the end of its bond purchases in March.

In this scenario, bond prices will almost certainly fall.

Your bonds are at risk for another reason, too… I’m talking about inflation itself.

Like it or not, it’s going to take the Fed some time to get a handle on inflation. The Fed must be careful not to act too quickly and shock the system, but inflation is red-hot today…

As Carlton noted on Tuesday, the U.S. Bureau of Labor Statistics’ Consumer Price Index – a gauge of inflation – increased 6.8% year over year in November. That’s the highest level since June 1982. And these price increases are playing out across the board…

The cost of electricity rose 6.5% over the past year. Natural gas prices are up 25% in that span. And gasoline is up 58% year over year… That’s the largest increase since 1980.

But the returns on supposedly “safe” investments like bonds aren’t keeping pace…

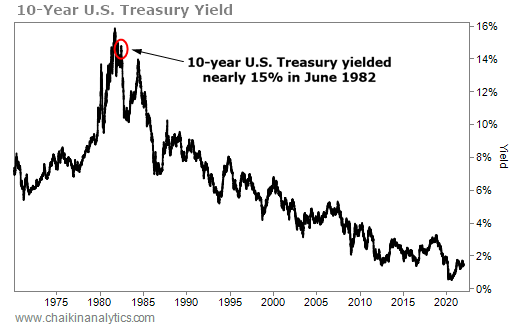

The 10-year U.S. Treasury note yields roughly 1.5% today. But do you know what the yield on that same maturity was the last time inflation reached 6.8% back in 1982?

It was almost 15%! Check it out…

Nowadays, the yield is a fraction of what it used to be. And if you go one step further, the “real” interest rate for those who own any bonds is likely negative… Yup, you lose money.

How?

Well, inflation is killing your buying power at a rate of 6.8% today… And if you’re holding a 10-year U.S. Treasury note, you’re earning a yield of 1.5%. The real interest rate is the difference between those two numbers (1.5% minus 6.8%), which equals -5.3% today. (That’s before you’re taxed on the 1.5%, too!)

That, my friends, is financial suicide.

Folks, the Fed is making it clear… Bondholders can pound sand today.

So for now, your best bet is to step aside from bonds while the Fed does its dirty work to tackle inflation.

Good investing,

Pete Carmasino