PepsiCo (PEP) made its way into the tech-heavy Nasdaq Composite Index five years ago…

That might sound strange on its own. After all, Pepsi is a soft-drink maker. It doesn’t scream “mega-tech company” to anyone.

However, the idea isn’t entirely outlandish. The Nasdaq is tech-heavy, but it’s not only tech stocks.

With that said… something even stranger is happening with Pepsi’s stock right now.

As I’ll explain, it’s a telling sign about the current state of the tech sector. And it leads us to another sector worth keeping our eyes on as we head into the new year…

First, let’s cover the strange situation with Pepsi’s stock…

In short, tech stocks have had such a bad year that Pepsi now sits near the top of the Nasdaq in terms of position weighting.

Yes, you read that right…

The most popular tech-focused index now features a soft-drink maker in its top 10 holdings. Pepsi is right there with Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META).

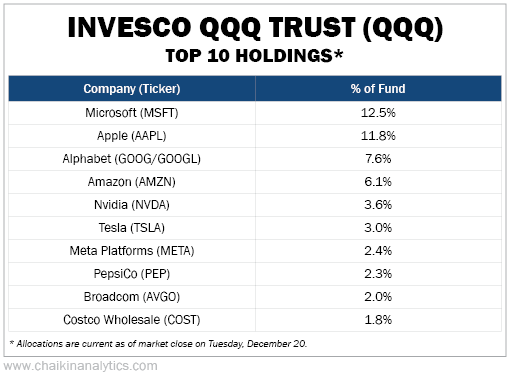

We can see the current allocations through the Invesco QQQ Trust (QQQ). This exchange-traded fund is widely considered to be the preferred Nasdaq-tracking vehicle in the market.

Here’s the current breakdown of QQQ’s top 10 holdings…

It’s a head-scratcher for sure. But let me be clear…

There isn’t anything wrong with Pepsi inching into the Nasdaq’s top 10 holdings. However, the stock is only up about 5% in 2022. That should tell you all you need about tech stocks.

And here’s why it matters for us as investors heading into 2023…

You see, Pepsi is in the consumer staples sector.

This sector is considered a “defensive” investment. And we’ve needed to play a lot of defense in 2022. So it makes sense that it has significantly outperformed this year…

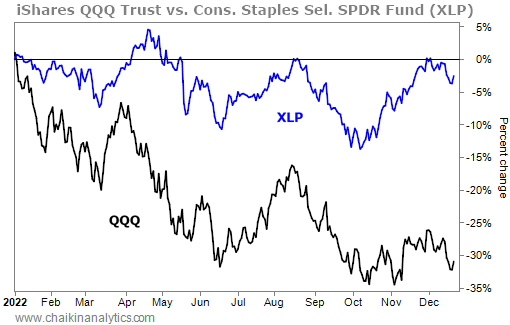

As you can see, the Consumer Staples Select Sector SPDR Fund (XLP) is only down about 2% so far this year. That performance trounces QQQ’s drop of more than 30% in 2022.

Now, look back at the list of QQQ’s top 10 holdings. You’ll notice that it features another consumer staples stock – membership-only retailer Costco Wholesale (COST).

That leads us to our takeaway…

Even the tech-heavy Nasdaq is signaling that the consumer staples sector is a great place to be as tech stocks tumble. It now features two stocks from this sector in its top 10 holdings.

Keep that in mind as investors continue to get defensive in early 2023.

Good investing,

Pete Carmasino