The pain continues for tech stocks…

The tech-heavy Nasdaq 100 Index has already lost roughly 34% this year. And of course, tech leaders like Meta Platforms (META) and Amazon (AMZN) are down much more.

But that doesn’t mean the worst is over for these stocks…

You see, after the COVID-19 panic in 2020, an influx of stimulus money mixed with low interest rates served as rocket fuel for tech stocks. Investors threw risk out the window.

That carefree attitude led to an incredible run higher for tech stocks…

The Invesco QQQ Trust (QQQ) – which tracks the Nasdaq 100 Index – peaked at more than $400 per share in late 2021. That was about 135% higher than its COVID-19 bottom.

But that was what I call a “false” high. It only happened due to all the stimulus money. And even worse, tech stocks could still fall a lot further in the days and weeks ahead.

As I’ll explain today, a critical signal could trigger as soon as this week. And it tells us that QQQ could plunge all the way down to $185 per share. That would be another 30% drop.

It sounds like a doomsday scenario. But it’s easy to see on the chart…

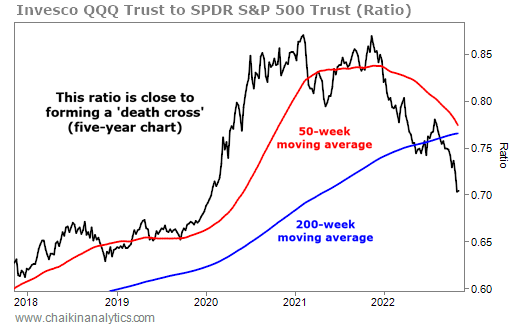

The chart below is a ratio chart. It’s the weekly look at QQQ divided by the SPDR S&P 500 Trust (SPY). And right now, it’s drawing a bleak picture for investors in tech stocks…

You see, this ratio is about to experience a “death cross” on a weekly basis. Take a look…

A so-called “death cross” typically occurs when an asset or ratio’s 50-day moving average moves below its 200-day moving average. Since we’re using a weekly chart in this case, we’re instead referring to the 50-week and 200-week moving averages.

It’s essentially the same thing. We’re just using a different time period.

In the chart above, the black line is the ratio, the red line is the 50-week moving average, and the blue line is the 200-week moving average. A death cross could happen any day.

Folks, that’s terrible news…

It means that the long-term trend for the QQQ (and tech stocks, in general) is turning lower. And as I noted earlier, that means things could soon get a lot worse for tech stocks…

On the long-term chart of QQQ, the next line of support is at $185 per share. Today, QQQ trades for about $263 per share. So it could fall another 30% before hitting support.

And don’t forget all the outside factors in play these days…

The stimulus is reversing. Economic slowdown is on the horizon. And even higher interest rates are still on the table.

Those factors all combine to create massive headwinds for tech stocks. That means the worst-case scenario for these stocks isn’t as farfetched as it might seem.

There is one silver lining, though…

If QQQ does hit that low, it will be a generational buying opportunity. At some point, we’ll be able to buy into tech stocks at bargain prices. And we’ll be able to hold them for years.

So for now, stay patient. Remember that tech stocks still have a lot of steam to blow off.

Good investing,

Pete Carmasino

Editor’s note: If you think what’s happening now is bad, watch out for 2023…

Chaikin Analytics founder Marc Chaikin believes a financial reset could cause a run on the banks unlike anything in U.S. history. But few people realize it – or what it could do to your wealth…

That’s why Marc is hosting a special online briefing next Tuesday, November 15. He’ll detail why it’s critical to move your money out of cash and popular stocks and into a new vehicle 50 years in the making.

The broadcast will begin promptly at 10 a.m. Eastern time. It’s free to attend. And just for showing up, you’ll get a free recommendation from Marc. Reserve your spot right here.