Value stocks have struggled to keep pace since the end of January 2004…

That’s when the Vanguard Value Fund (VTV) and Vanguard Growth Fund (VUG) debuted.

VTV has beaten VUG from time to time since then. But over the long run, VUG is the clear winner. Since inception, it’s up around 240%. Meanwhile, VTV is only up about 100%.

Last October, even value-oriented hedge-fund manager David Einhorn seemed frustrated…

Einhorn bemoaned the de-emphasis on classic security analysis. He noted that many value analysts had left the field. And he told Bloomberg, “I don’t know that it ever comes back.”

But there’s another side to this coin…

With fewer pros on the job, as Einhorn continued, “There’s an enormous number of companies that are dramatically misvalued in ways that we haven’t seen before.”

In other words, if you know where to look… an opportunity exists in deep-value stocks.

In 2014, Roundhill Investments launched the Roundhill Acquirers Deep Value Fund (DEEP) to look for these types of stocks. And today, the Power Gauge loves this opportunity…

DEEP tracks an index developed by Tobias Carlisle. If you’re not familiar with Carlisle, he’s the author of value-investing classics Deep Value and The Acquirer’s Multiple.

First, the exchange-traded fund (“ETF”) eliminates the largest 25% of stocks by market cap. Investors are less likely to deeply undervalue these widely followed stocks.

Then, DEEP scores each stock based on the so-called “acquirer’s multiple.” That’s enterprise value divided by earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

According to Carlisle, this approach values the company in the same way someone would if they were considering whether to acquire it. In other words, it’s value through the eyes of the folks who put their money behind their opinions.

Finally, DEEP goes through a series of steps I haven’t seen in any other value-focused ETF. It does the kinds of things a human securities analyst would do…

It calculates indicators of earnings manipulation and financial distress. It compares the stock’s price relative to a conservative valuation estimate. It evaluates financial strength. And it considers the company’s ability to generate free cash flow.

Finally, a forensic-accounting analysis considers financial-statement footnotes and management’s discussion and analysis.

The index scores each company for every factor.

After the analysis is complete, DEEP invests equally in the 100 companies with the highest scores. And it refreshes the portfolio once per quarter.

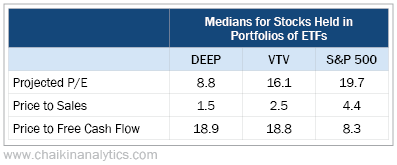

In the following table, you can see that DEEP is a much better value than VTV today…

If you’ve invested at all, you probably recognize these metrics. They’re well-known valuation ratios – projected price-to-earnings (P/E), price to sales, and price to free cash flow.

Nowadays, it’s hard to find stocks that are undervalued in terms of all three metrics. It usually only happens with struggling companies. But that’s not true with DEEP’s portfolio…

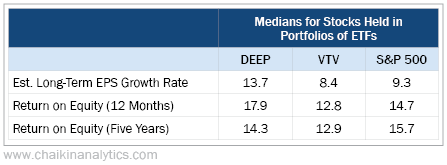

The fundamentals of the 100 companies in DEEP are solid, too. Take a look…

Return on equity is a premier measure of company quality. It shows the company’s profits as a percentage of shareholders’ capital.

As you can see, DEEP’s holdings fare well in this category. And they compare favorably in terms of projected future earnings-per-share (“EPS”) growth.

When we combine low valuations with good fundamentals, we have genuine value!

Right now, the Power Gauge sees a buying opportunity in DEEP…

Our system is “very bullish” on the ETF today. And its Power Bar ratio is firmly in the green zone. DEEP has 36 “bullish” or better holdings. And only seven holdings are “bearish” or worse.

Best of all… we could be nearing a time when the market better appreciates deep value.

The ETF’s relative strength was poor for several months. But thanks to the Power Gauge, I know it’s now inching closer to green again.

In other words, many investors are shifting back to deep-value stocks.

I won’t go as far as saying that value will now beat growth over the long term. But the Power Gauge is telling us that this classic approach is worth considering – at least for now.

Good investing,

Marc Gerstein