If you’ve ever seen an illusionist in person, it’s an incredible experience.

These magicians can seemingly make things vanish.

I once saw one of these performances at the Mirage hotel in Las Vegas. It featured white tigers suspended over the crowd that could “disappear.” And it was held by the iconic duo of Siegfried Fischbacher and Roy Horn – known professionally as Siegfried and Roy.

Between 1990 and 2003, the pair was as famous as the great magician Harry Houdini.

Siegfried and Roy had been working with jungle cats for more than four decades. And in the span of their 13 years at the Mirage, their act – which featured illusions – was famous on the Vegas Strip.

But in 2003, a tragic turn of events brought things to an end…

During a show in October that year, Roy was attacked by a white tiger. It took four men and a fire extinguisher to get the tiger to release him. Roy suffered massive blood loss and was partially paralyzed on one side of his body.

It was a terrible end to a popular show. Night after night, Siegfried and Roy entertained audiences with jungle cats and magic. Of course, everyone knew they didn’t actually make the tigers disappear. It was an illusion.

And right now, an illusion is much like what electric-vehicle (“EV”) maker Rivian Automotive (RIVN) does to billions of investors’ dollars. The management at this company makes money “disappear.”

And as I’ll explain today, I’m afraid it will also come to a tragic end for investors…

Now, this isn’t the first time I’ve discussed Rivian. Back in December 2022, I explained that the tech-heavy Nasdaq 100 index had chosen Rivian as its newest member.

At the time, RIVN shares were trading around $25. And I thought the move was “virtue signaling” because it couldn’t have been for the fundamentals of Rivian’s business.

The company was hemorrhaging cash. In 2022, it had lost almost $7 billion.

But the worst part is that investors eventually saw the “illusion” of a turnaround…

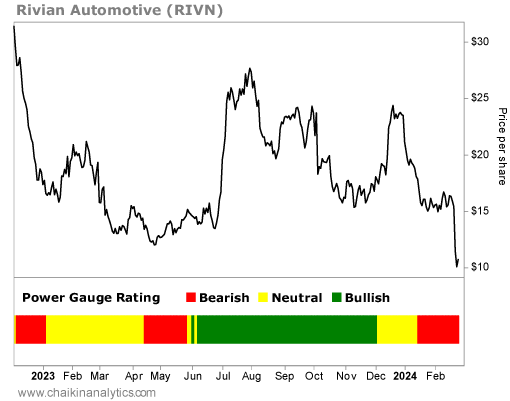

After the stock slid lower in early 2023, it eventually started to turn higher by the middle of the year. And by June 6, after months of “neutral” and “bearish” ratings, the Power Gauge flipped to “bullish.” That day, RIVN shares closed at $14.50.

Remember, our system uses 20 factors to review a stock’s fundamental and technical indicators…

The reason for the turn to “bullish” is the way the Power Gauge read the data. Rivian did report better sales, so metrics like the price-to-sales ratio improved… as did the near-term technical indicators.

You see, Rivian gave investors the illusion of a good stock. Both the Power Gauge and the Wall Street community began to increase their ratings – basing the changes on Rivian’s improving outlook and results. And by the end of July, the stock had hit a high of nearly $28 per share.

But then the stock slowly started to drift lower. And on December 4, the Power Gauge made a change to the downside. Rivian’s rating went from “bullish to “neutral” that day, with shares closing at $17.74.

And then, the Power Gauge turned even lower – flipping Rivian’s rating to “bearish” on January 16. Today, Rivian is still “bearish” in our system.

In the chart below, you can see how it played out…

But it seems that Wall Street hasn’t caught on yet.

Today, 54% of the analysts that cover Rivian still have a “buy” rating on it. And only 14% have a “sell” rating.

Sure, Rivian’s improvement in 2023 versus 2022 in terms of sales is a positive. But in the end, the company’s loss from operations totaled $5.7 billion in last year.

Folks, the “tigers” didn’t disappear. And Rivian still lost billions in 2023. Indeed, after the company reported earnings last week, RIVN shares collapsed by nearly 26% the next day.

A peek behind the curtain using the Power Gauge tells us Rivian is a stock to avoid for the foreseeable future.

Good investing,

Pete Carmasino