Folks, a dangerous combination is brewing beneath the surface today…

In fact, it’s what I like to call the “trinity of trouble.”

When inflation and interest rates rise together, it puts a huge strain on U.S. consumers. That’s happening today, of course. And it’s even worse when a third factor is rising as well…

You see, credit-card balances are growing in the face of higher rates.

When inflation, interest rates, and debt levels all head in the same direction… things won’t end well.

The problem is… U.S. consumers are sometimes blind to the consequences of overleverage. (Heck, as we discussed last Friday, even U.K. pension funds suffered from that problem.)

Of course, some Wall Street observers will tell you that this problem is overblown…

These folks argue that wage growth will continue to move up. And as that happens, they expect consumer prices to magically return to their previously normal levels.

But I’m here to tell you today… that’s wishful thinking at best.

The main issue is simple…

The markets need the American consumer to stay healthy. After all, U.S. household consumption accounts for roughly 70% of our gross domestic product.

In the wake of the COVID-19 pandemic, U.S. consumers started to redeploy their spending. But there’s a dark side to this increased spending…

Surging debt levels.

Consider this…

Total household debt in the U.S. increased by $312 billion in the second quarter. And now, balances are more than $2 trillion higher than they were in the final quarter of 2019.

A lot of people are using debt to buy things simply because prices have gone up so much. For example, the average dollar amounts of new homes and cars are both up 36% from 2019.

And wages aren’t keeping pace with inflation. The Economic Policy Institute showed that the 2021 national median income has increased a paltry 0.1% since 2019.

So naturally, debt is increasing. Folks want to keep living their same lives – inflation or not.

Credit-card companies know what to do in this environment. They’ll raise interest rates to hedge against “delinquencies.” That’s the term for folks who struggle to pay their bills on time.

And the thing is… delinquencies are already increasing.

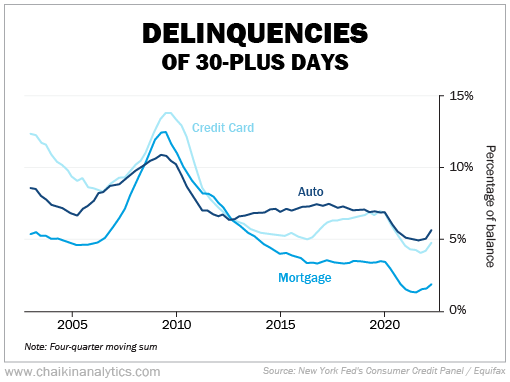

You can clearly see what I mean in this chart from the New York Fed’s Consumer Credit Panel. It breaks down the percentage of folks who are 30-plus days late on various loan types…

Now, as you’ll notice, delinquency rates are nowhere near the 2008 crisis peak yet. But any uptick in this environment is dangerous.

The Consumer Financial Protection Bureau (“CFPB”) is on alert as well…

In 2021, the CFPB noted that the difference between the prime rate and the average rate on credit cards was at record highs. And back then, delinquencies were at record lows.

So folks, if the CFPB was worried about rising credit-card rates back then, it’s likely even more concerned today.

Our takeaway is simple…

The trinity of trouble is brewing beneath the surface. Delinquencies are starting to creep higher at the same time that we’re living with rising inflation and interest rates.

It’s wishful thinking at best if you think this problem will just fix itself. It’s becoming clearer and clearer that things won’t end well.

So tomorrow, we’ll look at two companies that will suffer the most as this crisis unfolds.

Good investing,

Pete Carmasino