Editor’s note: The markets and our Chaikin Analytics offices will close Monday, January 16, for Martin Luther King Jr. Day. As a result, we won’t publish our Chaikin PowerFeed e-letter that day. Look for your next issue on Tuesday, January 17.

It’s hard to know who to trust these days…

As my colleague Marc Gerstein detailed yesterday, a huge contradiction exists in the economy.

On one hand, a new Bloomberg survey points to the “most widely anticipated recession in history.” But on the other hand, most analysts’ earnings estimates are far too rosy for a recession.

That doesn’t mean the so-called “smart money” is sitting idle, though. In fact, the data today tells us this group of investors is betting on – and preparing for – a recession.

Here’s how we know…

There are two types of traders in the world – the “dumb money” and the “smart money.” And it’s exactly what it sounds like…

We don’t want to be on the side of the dumb money.

These small-time traders want to get rich quickly. But their timing is usually terrible. They’re typically two to three steps behind the smart money. And in turn, they get burned more often than not.

The other group is called the smart money for a reason…

It’s made up of large institutional investors – such as pension funds, mutual funds, and hedge funds. And unlike the dumb money, these Wall Street pros are right more often than they’re wrong.

Just as important, they trade in large sums. And large sums leave footprints.

In the early 1980s, Chaikin Analytics founder Marc Chaikin developed a way to track these footprints. It’s called the Chaikin Money Flow indicator.

This indicator measures the accumulation (buying pressure) versus the distribution (selling pressure) of a stock over time. And it focuses on the closing price. That’s important…

You see, institutions need to trade just after the open or just before the close because that’s where the markets are most liquid. And since the Chaikin Money Flow indicator tracks the closing-price data for a stock, it’s a great measure of smart-money activity.

In our Power Gauge system, the Chaikin Money Flow indicator is a green-red oscillator. It ranges from +100 to -100. Positive numbers show net buying pressure, while negative numbers show net selling pressure.

And when we look at the Chaikin Money Flow indicator today, it’s obvious… the smart money is betting on a recession.

When the smart money expects a recession, it gets “defensive.” It starts putting money into sectors that do well in tough times – like utilities, consumer staples, and health care.

That’s exactly what’s happening today…

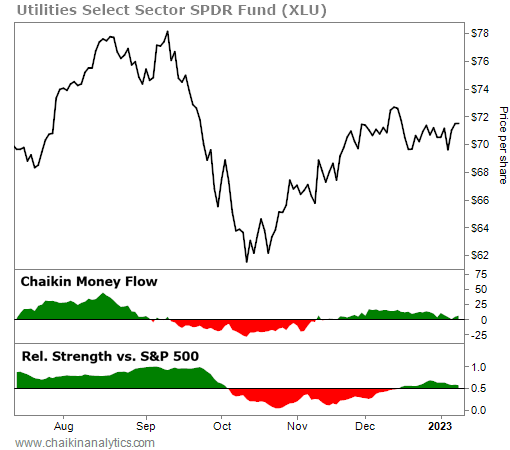

To see what I mean, let’s look at the Utilities Select Sector SPDR Fund (XLU). The panel below the main price chart shows the Chaikin Money Flow indicator. Take a look…

Notice that the Chaikin Money Flow indicator was positive back in August. But then, the smart money dried up.

That makes sense, though. Fears of an imminent recession subsided at the time. And not long after that, the utilities sector began to underperform the benchmark S&P 500 Index.

But now, the smart money is turning back to this defensive sector. As you can see, the Chaikin Money Flow indicator has been in the green zone since mid-November.

And in recent weeks, the utilities sector started outperforming the S&P 500 once again.

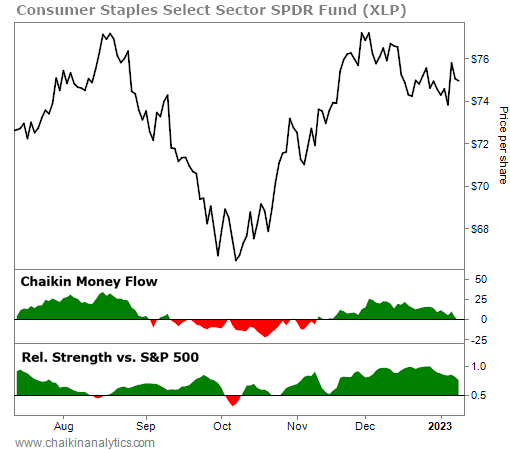

The picture is even clearer in another defensive sector – consumer staples…

The Chaikin Money Flow indicator for the Consumer Staples Select Sector SPDR Fund (XLP) turned green in mid-November, too. And the sector has outperformed the S&P 500 since this time last year. Take a look…

In the end, our takeaway is clear…

The smart money is preparing for a recession today. We should do the same.

Good investing,

Karina Kovalcik