We’re heading into “one of the most anticipated recessions of all time”…

Or maybe not.

Bloomberg surveyed more than 500 Wall Street strategists to kick off the new year. And the news service concluded that we should expect “fresh pain for investors” in 2023.

But not everyone got the memo apparently…

As I’ll explain today, for the most part, analysts’ earnings estimates aren’t currently what we would expect in a recession. Many estimates are way too high.

And that means if a recession happens this year, things could get ugly for many stocks.

Let me explain…

Generally, stock prices reflect future expectations. After all, you buy a stock because of what you expect to happen in the future as you own it.

With that in mind, let’s assume Bloomberg’s forecast of “one of the most anticipated recessions of all time” is correct…

That’s an expectation about the future. So in turn, we can also assume that stock prices already reflect that outlook today.

And as my colleague Karina Kovalcik explained Monday, a recovery period follows a recession in the economic cycle. When that happens, we should expect stock prices to rise.

But things are more complicated this time. And it comes down to corporate earnings…

You see, earnings don’t just fall in a recession. They fall a lot.

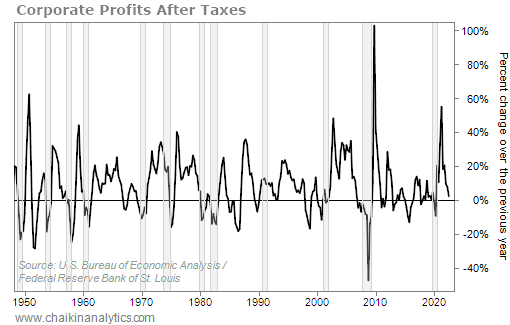

Here’s a long-term picture of annual percentage changes in corporate profits…

The gray bars denote all the recessions in the U.S. since the late 1940s. Notice how earnings growth usually goes negative (meaning, earnings fall) during those periods.

Also notice that the earnings changes in 2008 and 2009 were much worse than normal. That wasn’t a typical recession. It was a once-in-a-generation meltdown of the global financial system.

We’re expecting a more “normal” kind of recession this time. These types of recessions happen when demand for goods and services drops to correct an “excess” in the system.

Today, the excess is about money supply. Too much money chasing available goods and services led to out-of-control inflation in the wake of the COVID-19 pandemic.

The nature and causes of excesses change from recession to recession. Their common trait is that the system corrects by slowing down or experiencing reduced demand.

Again, this recession will likely be more like normal. So we should pay closer attention to the earnings declines in similar recessions. They suggest a decline in the 15% range.

But the thing is… earnings estimates don’t align with that expectation today.

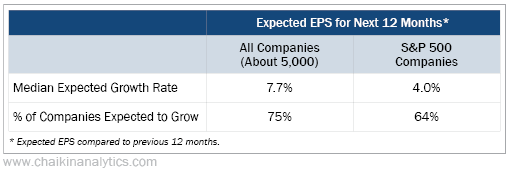

The following table breaks down expected earnings-per-share (“EPS”) reports over the next year. It’s split into two categories – all companies and those in the S&P 500 Index.

Take a look…

Put simply, that kind of growth is not what happens in a recession. It’s not even close.

The current feelings from analysts are out of line with the “most widely anticipated recession.” And that could spell disaster for investors if a recession plays out this year…

You see, it means a lot of stocks are still overpriced based on future expectations. And if a recession happens, it will cause a lot of surprises – and pain – for investors…

Investors hate earnings shortfalls, reduced estimates, and lower guidance. So if a recession changes analysts’ future expectations in the months ahead, many stocks will get crushed.

Whether you anticipate a recession or not, now is the time to prepare just in case.

Good investing,

Marc Gerstein