Market pundits fixate on round numbers and milestones…

I remember “Dow 10,000″… then “Dow 20,000.” The index is well above 30,000 these days… And it could hit 40,000 as soon as this year. Imagine that… “Dow 40,000.”

It’s the same story with individual stocks… Pundits love to talk about share prices. They debate when a stock will eclipse $100, $200, or $300 per share.

Pundits also focus on the total value of a company – its market capitalization, or “market cap.” That’s the dollar amount of each share multiplied by all the outstanding shares.

Consumer-electronics giant Apple (AAPL) recently smashed the market cap record… It became the first company valued at more than $3 trillion.

That’s a huge number… And not surprisingly, the pundits can’t stop talking about it.

What’s in a number, though? Does this signal the end of Apple? Is Apple overvalued now?

Let’s start with the case of another milestone-making company…

In the early 1990s, Cisco Systems (CSCO) was a relatively obscure network hardware company. It made switches, routers, and other products that linked computers together on networks. (It still does today, too.)

Then, the Internet boom happened… By 2000, Cisco became the world’s most valuable company. Its market cap rose to more than $550 billion.

Analysts started predicting that Cisco’s market cap could surpass $1 trillion one day. Pundits chewed it over… They couldn’t believe that a single company could be worth that much.

As it turns out… it wasn’t.

Not long after that, the dot-com bust happened. Cisco’s stock crashed all the way through late 2002… Its value plunged roughly 90% in that span. And it hasn’t come close to reaching its peak valuation again. It’s valued at around $260 billion today.

Back in 2018, Apple started flirting with the $1 trillion mark. And folks began thinking just like they did about Cisco… This can’t be a good thing for Apple going forward.

But in August of that year, the stock blew through that level. And it hasn’t slowed down…

That’s because Apple is an excellent company. It has great earnings power and an incredible “moat” around it. (A moat is essentially a barrier against competition.)

Apple’s moat is its loyal user base… It brings a revenue stream that almost no other company can penetrate.

I’m one of millions of folks using the iPhone 13, for example. My entire extended family uses Apple’s products… We’ve likely bought well over 200 devices from the company over the years. And it’s a similar story with almost everyone I know.

Once you’ve started using Apple’s devices, you’re locked in… You end up buying apps, music, and movies to enhance the experience with your iPhone or iPad. And of course, Apple gets a cut of every single transaction.

That’s a moat.

Apple reached $2 trillion in market cap in August 2020. And just 17 months later, its market cap touched $3 trillion on the first trading day of 2022. Its value has dipped slightly over the past week or so, but it’s still hovering just shy of that round number today.

So… now what?

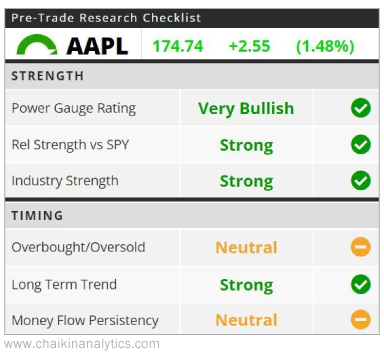

For that, we’ll turn to our proprietary “Power Gauge” system. Specifically, we’ll focus on the “Pre-Trade Research Checklist” – one of many features available to Power Gauge users…

As you can see in the upper-left corner next to the ticker, the Power Gauge rates Apple as “very bullish” today. The checklist also shows us that the stock is performing well compared with the overall market… And the company is in a strong industry group.

As far as timing, the price action is in a strong long-term trend. If Apple pulls back slightly, it could drop the stock into “oversold” territory… That would give investors a solid buying opportunity.

We’ve seen today that numbers are sometimes meaningful… But other times, they’re just levels to make a news story or give the pundits something to rattle on about.

When it comes to Apple, focus on the fundamentals… The company’s massive moat will propel it into the future. It supports the Power Gauge’s very bullish take on the company.

And at some point, the pundits will all be talking about the stock as it nears $4 trillion.

Good investing,

Carlton Neel