Inflation is at highs not seen since the early 1980s…

Supermarket shelves are still empty, with no end in sight to our supply-chain woes…

And behind everything, COVID-19 still looms large.

These fears are starting to spread into the stock market as well…

Tech stocks and small caps are officially in a “correction.” And the S&P 500 Index and Dow Jones Industrial Average are getting close.

With all that said, you might be wondering if it’s time to throw in the towel on stocks…

The short answer is… Heck no!

As an investor, you must remember that you can almost always find opportunities somewhere in the markets. And that’s still true today.

Even better, we don’t need to hunt them down ourselves. Instead, we can trust the Power Gauge to do the grunt work for us…

The Power Gauge diligently watches more than 4,000 stocks and exchange-traded funds (“ETFs”). At any given time, it can help us see the best places to put our money to work.

Importantly, the Power Gauge just spotted a “smart money” binge happening in one corner of the market. And the sector might surprise you…

It’s plain, old consumer staples.

Simply put, the big shots in the investment world are rotating out of growth-focused, riskier areas of the market. They’re turning to other, more “boring” areas like consumer staples.

We’re talking about a sector with stocks like Procter & Gamble (PG), Pepsi (PEP), and General Mills (GIS) in it. It’s packed with all the essentials you expect to see at the store.

And let’s be honest… who gets excited about investing in soap, toilet paper, soda, and cereal?

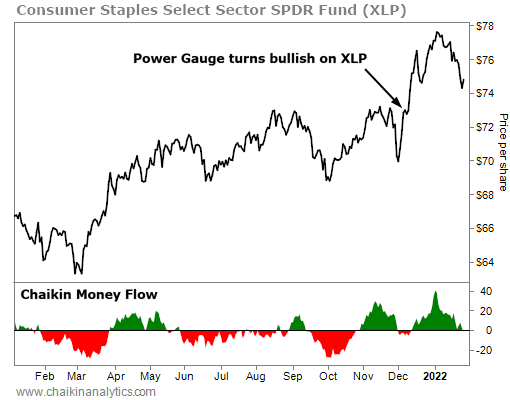

Well, the cash-flow consistency and predictable sales of many consumer staples companies is a safe harbor for investors during a storm. The Power Gauge sees that, too. Take a look at the following chart of the Consumer Staples Select Sector SPDR Fund (XLP)…

In the bottom panel of the chart, our Chaikin Money Flow indicator shows us that the so-called “smart money” institutional traders are rotating their portfolios toward these companies right now. In fact, the Power Gauge spotted this shift starting back in October.

That’s part of why the Power Gauge issued a “bullish” rating before the ETF started outperforming the S&P 500 in recent weeks…

You see, consumer staples underperformed the S&P 500 for the better part of the past year. But in early December, these stocks started kicking the broader market’s butt.

More importantly, the Power Gauge saw it coming. And it shouted “buy now” before this outperformance even started.

The Power Gauge also rates every individual stock inside the consumer staples ETF. And right now, it isn’t “bearish” on any of these 32 companies.

In other words, the Power Gauge currently rates every company trading under this one ticker symbol as “neutral” or better. So not surprisingly, the Power Gauge also sees the ETF as a “very bullish” opportunity right now.

It has been a tough start to 2022 for investors. Folks with tech-heavy portfolios are hurting.

But that doesn’t mean we’ve run out of opportunities. The Power Gauge is always on the hunt for the best places to invest, no matter what’s happening in the overall market.

Don’t give up… Opportunities abound. You just need to know where to look.

Good investing,

Carlton Neel